In the ever-evolving landscape of real estate, grasping the nuances of property valuation metrics is crucial for making informed investment decisions. Among these metrics, the median house price stands out as a pivotal indicator, offering insights into market trends and helping investors identify lucrative opportunities. This guide delves deep into the concept of median house prices, elucidating its calculation, significance, limitations, and how it compares to other valuation methods.

What Is the Median House Price?

The median house price represents the middle value in a list of property sale prices arranged from the lowest to the highest. Unlike the average (mean) price, which sums all sale prices and divides by the number of sales, the median provides a more accurate reflection of the market by mitigating the impact of extreme values.

Example:

Consider seven property sales with the following prices:

- $599,000

- $630,000

- $691,000

- $719,000

- $778,000

- $883,000

- $985,000

Arranged in ascending order, the median price is the fourth value: $719,000. This means half the properties sold for less, and half sold for more.

Why Is the Median Price Preferred Over the Average?

The average house price can be significantly skewed by outliers—properties sold at exceptionally high or low prices. For instance, if a luxury mansion sells for a much higher price than other homes in the area, it can inflate the average, giving a misleading impression of the market.

In contrast, the median price remains unaffected by such anomalies, providing a more stable and reliable indicator of typical property values within a market.

Calculating the Median House Price

To calculate the median:

- List all sale prices in ascending order.

- Identify the middle value:

- If the number of sales is odd, the median is the middle number.

- If even, the median is the average of the two middle numbers.

Example with an Even Number of Sales:

Sale prices: $500,000, $550,000, $600,000, $650,000

Median = ($550,000 + $600,000) / 2 = $575,000

Interpreting Changes in Median House Prices

An increase in the median house price suggests a general rise in property values, indicating a seller’s market. Conversely, a decrease may signal a buyer’s market. However, it’s essential to consider the context:

- Market Composition: A surge in high-end property sales can elevate the median without reflecting a genuine market-wide price increase.

- Sales Volume: A low number of sales can make the median less reliable.

Therefore, while the median provides valuable insights, it should be interpreted alongside other market indicators.

Median House Prices Across Australia

As of recent data:

- Sydney: Median house price is approximately $1.36 million, reflecting its status as Australia’s most expensive city.

- Melbourne: Around $1 million, showcasing steady growth.

- Brisbane: Approximately $850,000, indicating rising demand.

- Perth: Around $775,000, with notable year-on-year increases.

These figures illustrate the varying market dynamics across Australia’s major cities, emphasizing the importance of localized market analysis.

Utilizing Tools for Enhanced Market Research

Modern technology offers tools that aggregate and analyze vast amounts of real estate data, aiding investors in their decision-making process. Platforms like SuburbsFinder provide:

- Customizable Filters: Narrow down suburbs based on specific criteria.

- Historical Data Analysis: Track trends over time.

- Comparative Reports: Evaluate multiple properties or areas simultaneously.

By leveraging such tools, investors can identify high-growth suburbs, assess investment viability, and strategize effectively.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

Limitations of Relying Solely on Median Prices

While the median house price is a useful tool, it has its limitations:

- Does Not Reflect Property Characteristics: The median doesn’t account for differences in property size, condition, or location.

- Ignores Market Segmentation: In areas with diverse property types, the median may not accurately represent specific segments.

- Sensitive to Market Activity: In markets with low sales volumes, the median can fluctuate significantly with each sale.

Complementary Metrics for a Holistic Market Analysis

By analyzing these metrics in conjunction with the median house price, investors can make more informed decisions.

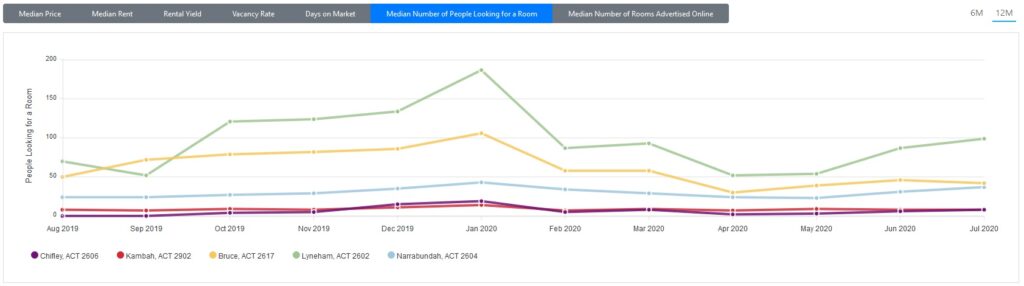

- Days on Market: Indicates how quickly properties are selling.

- Vacancy Rate

- Capital Growth

- Household Income

- Rental Listings (Rental Stock): Highlights rental demand in the area.

- Sale Listings (Stock on Market)

- Online Search Interest/Demand

- Percentage of Owner and Renter

Combining Different Real Estate Data will Provide the Best Insights for Data Driven Investment Property Decisions.

When combined with these real estate data points, we can use median house prices to see the trend of demand for properties in a suburb. If the median prices are rising along with decreasing vacancy rates, days on market, and sale listings, it indicates an increasing demand and the resultant rise in house prices.

Combining median prices with household income will tell you the economic growth of residents in the area over a period. For example, rising median prices could mean the that house prices are increasing in general, however, we can be more certain if we combine this with a similar rising trend in household income.

An increase in Local Government Building Approvals equals a relative rise in available properties in an area. Significant regulations like these can affect median prices as a larger influx of houses into the market will affect property prices changing the trend over time.

It is important that you carry out your research and due diligence when planning to invest in property. Our fully customisable tool will help you in choosing which areas have both Good Capital Growth and Positive Cash Flow. It lets you narrow down 15,000+ suburbs by combining all 40 data points as filters. It also lets you compare suburbs’ historical & current performance. And once you have identified the best location, it also lets you do feasibility studies on 5 properties all at the same time. Thereby saving time, budget, and covering the full cycle of your investment property research workflow

So, if you think what we’ve built will drastically decrease your time researching for the best location and finding the right property based on your goals and financial situation, sign up for free and give it a try now!

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcode. It’s the perfect tool for property investors looking to buy a property.

Understanding the median house price is fundamental for any property investor aiming to navigate the real estate market proficiently. While it offers valuable insights into market trends, it’s crucial to consider it as part of a broader analytical framework, incorporating various metrics and tools to make well-informed investment decisions.

For those seeking to delve deeper into property market analysis and identify promising investment opportunities, exploring comprehensive tools and resources is a prudent step forward.