Real estate data is simply facts and statistics about properties, suburbs, their purpose, their value, and their residents collected together for reference or analysis. Without proper investment property analytics, it will be impossible to make data driven decisions about where to invest your money-wisely.

With so much information readily available, the problem then lies in understanding how to use real estate data to identify the most profitable areas or suburbs in the market and reduce your risk. There are different real estate data that you can combine and analyse for your investment property decision.

10 Important Real Estate Data to Look At

There is so much investment property data out there that it can be difficult to make sense of this tidal wave of information. To help you out, here are 10 important real estate data points to look out for when searching for the best investment properties.

- Days on Market

- Rental Yield

- Capital Growth

- Household Income

- Vacancy Rate

- Rental Listings (Rental Stock)

- Sale Listings (Stock on Market)

- Online Search Demand

- Median Price

- Percentage of Owner and Renter

Note that no single data point paints the full picture of a potential area to buy an investment property. For example, knowing the rental yield of a property doesn’t tell you how long rental properties typically remain vacant in that area. Combining different real estate data points will provide the best insights for data driven investment property decisions.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

What Insights can you get by Combining Different Data Points?

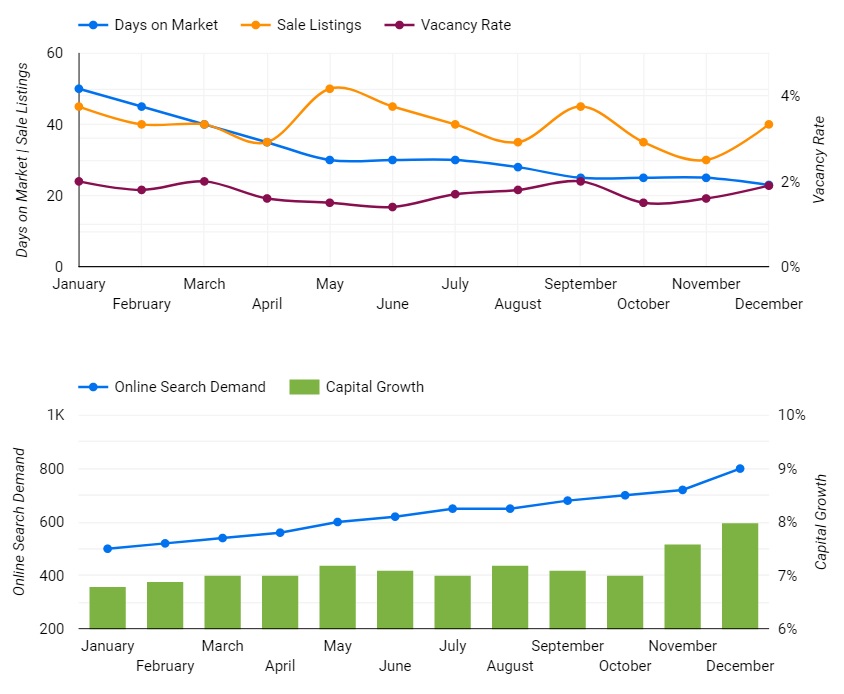

a. A low vacancy rate combined with low days on market, low sale listings, high online search demand, and a high percentage of owners.

All of these real estate data point to a high level of demand for properties in that suburb. Vacancy rate is a measure of the number of rental property units in an area that are vacant at any given time. A low vacancy rate means that properties are less likely to remain vacant after a tenant moves out.

When combined with low days on market, which is the number of days a property stays listed for sale or rent, we can infer that demand outstrips supply. A high online search demand tells us that there is a lot of interest in that suburb. Whilst a high percentage of owners means less there is less competition if you’re planning on putting your property up for rent.

Low vacancy rate, low days on market, low sale listings, high online search demand, and a high percentage of owners represent a strong demand for property in an area. Since real estate prices are determined by the forces of demand and supply, an area having data that shows a high degree of interest is always desirable.

When demand exceeds supply, prices are likely to go up as people are willing to pay more for a piece of property. This is favourable for investors looking to increase the value of their investments. But when supply exceeds demand, prices are more likely to go down to compensate for over availability.

b. A low vacancy rate combined with low days on market, low sale listings, high online market demand, and a high percentage of renters.

Similar to the scenario above, low vacancy rate, low days on market, low sale listings, and high online search demand represent a potentially favourable demand for property in an area. The difference this time is a higher percentage of renters than owner-occupiers.

A renter is someone who pays rent for the use of another’s property while an owner-occupier buys a property to live in it. Renters typically have less attachment to their properties than owner-occupiers. They are also less likely to improve the value of their property over time, reducing the general quality of properties in suburbs dominated by renters.

c. A low vacancy rate combined with low days on market, low sale listings, high online market demand, and high capital growth.

Capital growth refers to the increase in the value of a property over time. For instance, if you bought a property for $700,000 and sell it for $770,000 a few years later, the property experienced capital growth of $70,000 or 10%.

This is valuable to investors as it represents the money earned without any extra effort on their part. Investing in an area with a high capital growth (as well as other favourable real estate data) will ensure that the value of your investment increases over time.

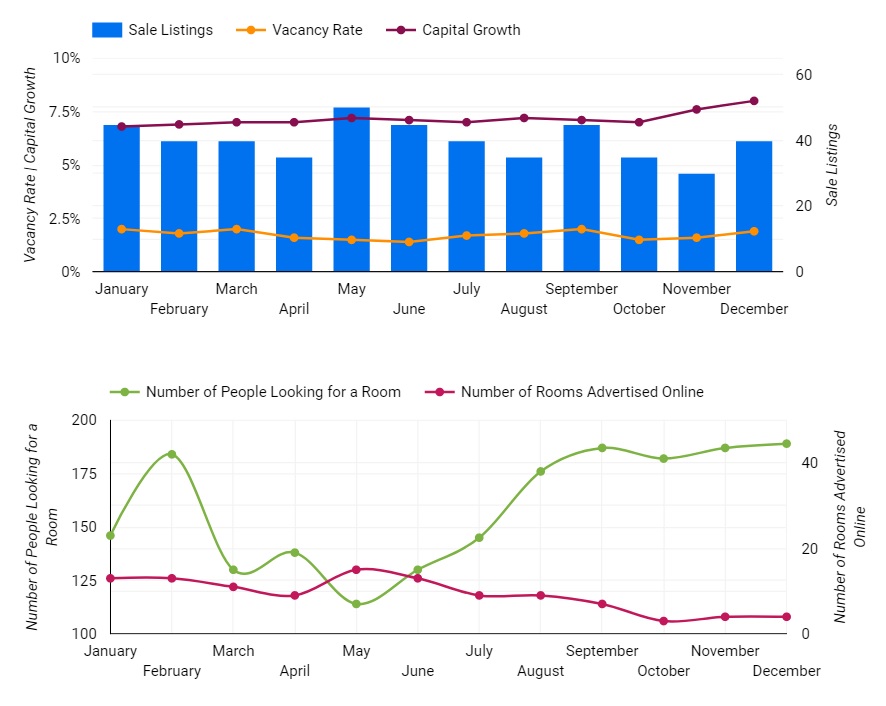

d. A low vacancy rate combined with low sale listings, high online market demand, high capital growth, high median number of people looking for a room, and low median number of rooms advertised online.

The median number of people looking for a room is the middle point for rental demand over a given period, usually a month. This is the same as the median number of rooms advertised online. Median numbers are used to give a better representation of the people’s interest in an area.

A high median number of people looking for a room could be a sign of increasing interest in rental properties in a suburb. While a low median number of rooms advertised online could signify scarcity of rooms for rent in that area which puts demand ahead of supply.

This could mean that there are more single people within the area who prefer to rent a room to save money compared to renting a one-bedroom apartment. If this is the case, there’s a better opportunity to have both capital growth and positive cashflow when buying investment property in areas having this data by renting out rooms individually.

Case example: If you buy a 5- bedroom investment property in an area with an average annual growth of 8% for $700k, your property can double its value to $1.5M after 10 years. And if you rent out each room individually at $250/wk, that’s a total of $1,250/wk for the 5 rooms resulting to 12% rental yield and a positive cashflow. As compared to renting out the property traditionally for only $600/wk with only 5.5% rental yield.

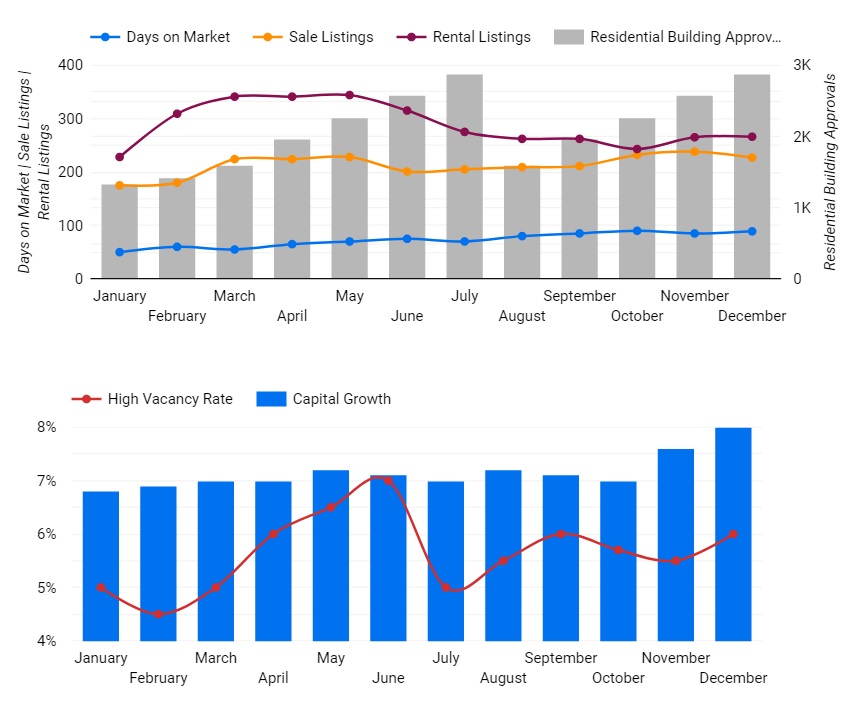

e. A high vacancy rate combined with high days on market, high sale listings, high rent listings, high residential building approvals, and high capital growth.

A high vacancy rate means that it takes longer to refill property in an area with new tenants after it is vacated. When coupled with high days on the market, we can assume that properties in that area are not high in demand.

The sale and rent listings are used to indicate the level of supply. A high score could mean there are more properties in supply than the rate of demand.

Since building approvals must be obtained before any building work can start, high residential building approvals show an abundance of private dwellings approved in the area’s housing market.

We can infer from this that it might take longer for properties to sell and to rent in this area because supply outweighs demand. But note that even with such data, property prices will still increase. But the increase in house prices will take longer than expected. So, it probably wouldn’t be the right area for you to buy your investment property if your strategy includes extracting equity in 2 or 3 years’ time.

f. Population below 5,000 and high percentage of less than $650 gross weekly income.

The more people earn, the higher priced their homes are. A high-income household will live in a high value house… and as uncomfortable as it is to say, it’s also common sense that a low-income household is more likely to live in a low value house.

An area with small population base may be reliant on one industry. This creates a higher risk for investors if that industry was to experience a downturn. A downturn can flow onto higher unemployment levels leading to people leaving the town because there are no jobs. Demand for housing (both for sale and lease) decreases, vacancy rates rise, rents fall and prices can fall. Consumer confidence in the market place is ultimately affected.

If the main contributor for an increase in population is births, then this is not as positive for the short term, than if the increase is due to migration. Net overseas and net interstate migration is an important component for population growth as a majority of these migrants need accommodation immediately. Sydney and Melbourne have both experienced phenomenal rates of net interstate and net overseas migration and consequently, demand has increased and pushed up the median price in both of these cities.

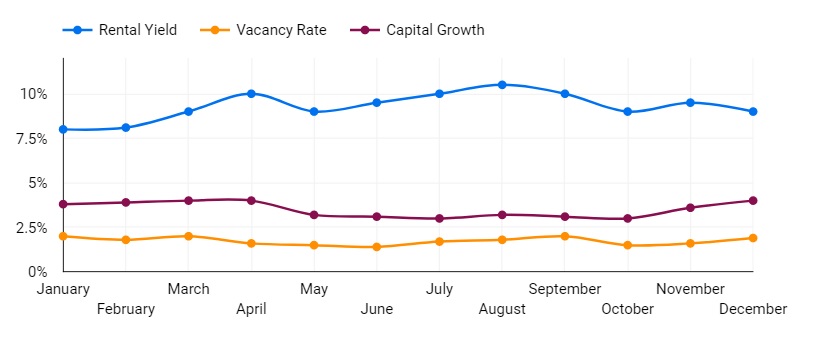

g. High rental yield, low vacancy rate, low average annual growth.

The rental yield is a measure of how much a property earns in a year. Areas with high rental yield provide a strong investment opportunity as you get more cash flow from the property. A low vacancy rate means that this source of income is less likely to be disrupted in future.

However, a low average annual growth shows that the value of the property may not experience much growth over time.

Suburbs with these data points will be great places to buy investment properties for cashflow but perhaps not for capital growth where you can extract equity within 2 to 3 years.

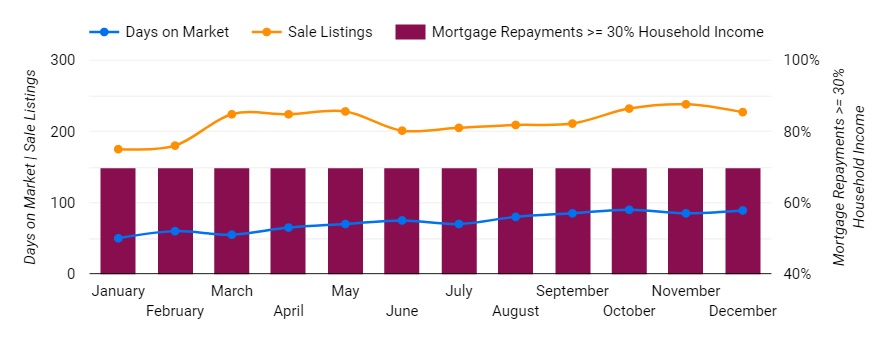

h. A high percentage of households with mortgage repayments greater than or equal to 30% of household income, high sale listings, high days on market.

Households with mortgage repayments greater than or equal to 30% of household income are more likely to experience mortgage stress and difficulties maintaining their pre-mortgage lifestyle. This could also mean limited surplus cash to improve the value of their property over time.

High sale listing could mean there are more properties in supply than the rate of demand. And high days on market tell us that properties in the area spend a long time before being closed on, a sure sign of an area with weak demand and where supply for property outstrips demand. If stuck in this scenario, house prices will most likely tend to decline.

What Combination of Real Estate Data Points You Should Look at to Identify Suburbs Experiencing Strong or Weak Demand

There is no exact science to interpreting real estate data as it all boils down to the % of importance and relevance of each data point to you, as well as other personal factors for buying. But generally, suburbs with a low vacancy rate combined with low days on market, low sale listings, high online search demand, high capital growth, and high rental yield are most likely experiencing strong demand.

And on the other hand, suburbs with high vacancy rates, high sale listings, high days on market, and a high percentage of low-income earners may experience weak demand.

When taking into consideration your reasons for buying a property, owner-occupiers may have no use for rental yield or vacancy rates, whilst such are essential to potential investors.

How do Population and Household Income Affect the Demand and Desirability of a Suburb?

The higher the population in an area, the greater the demand is for housing.

Real estate data, like the percentage of households with a weekly household income of more than $3,000 tells us more about the demographics of a suburb. Households in a higher income bracket can afford to improve the value of their property or can afford to pay more rent, leading to a more desirable suburb overall.

It’s always important to look at 6 to 12 months historical data trend, or even longer, because that tells you what’s happening in that area and possibly where it is heading.

How to Predict Suburbs with Future Capital Growth Potential and Avoid the Suburbs that could lead to Financial Disaster

Although there is no way to guarantee that a property will increase in value, you can increase your chances by carrying out detailed research on the property you are interested in and the suburb it resides in.

By analysing a suburb’s past performance, combined with other factors, investors can predict future capital growth and identify gaps where suburbs can potentially catch up in capital growth. Primary indicators of capital growth include:

- Future infrastructure developments

- Increases in household income levels

- Population growth forecast

- Overseas & interstate migration

- Employment

- Number of Development Approvals for new dwellings (houses/townhouses/apartments)

These data points combined with the suburb’s historical performance data trends can help predict future capital growth.

It is important to understand how to use real estate data to identify the most profitable opportunities in the market and minimise losses. With so much data out there, you can get the best insights by combining different data points. As combining data and marrying them together can lead to smarter and strategic investment decisions.

Our fully customisable tool will help you in choosing which areas have both Good Capital Growth and Positive Cash Flow. It lets you narrow down 15,000+ suburbs by combining all 40 data points as filters. It also lets you compare suburbs historical & current performance. And once you have identified the best location, it also lets you do feasibility studies on 5 properties all at the same time. Thereby saving time, budget, and covering the full cycle of your investment property research workflow

So, if you think what we’ve built will drastically decrease your time researching for the best location and finding the right property based on your goals and financial situation, why don’t you sign up for free and give it a try.

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcode. It’s the perfect tool for property investors looking to buy a property.