Rental Yield measures the return on investment from a rental property each year as a percentage of the value or price which the property was bought. This is an important real estate data that tells potential investors how much money they will make on a particular property before investing in it.

There are two types of rental yield to consider when doing your calculations: gross rental yield and net rental yield.

- Gross Rental Yield: The total annual rent received from tenants divided by the property’s total market value multiplied by 100 to get the percentage. This gives you the total profits on a rental property before expenses.

- Net Rental Yield: The total annual rent received from tenants minus the total property expenses including repairs, maintenance fees, management costs, insurance, and other charges. Although harder to calculate, the net rental yield produces a more accurate result.

A high rental yield means that investors get more cash flow from the property, which improves their return on investment. In other words “positive cashflow”.

How to Calculate Rental Yield? Are you Calculating it Correctly?

In most cases, investment properties are advertised with the rental yield figure on the property’s market listing. However, many real estate market listings only show the gross rental yield.

You can avoid this by taking a few minutes to run some simple calculations to get the gross rental yield and net rental yield.

How to Calculate Gross Rental Yield

The formula for calculating gross rental yield is:

Annual rental income x 100

Price of the property

This means that if a property generates $1,500 per week in rent and is advertised for sale at $1,000,000, the gross rental yield is as follows:

- Multiply $1,500 by 52 (weeks) to get the annual rental income which is $78,000.

- Next, divide $78,000 by total market value which is $1,000,000 = 0.078.

- Finally, multiply 0.078 by 100 to get the percentage, this gives us a gross rental yield of 7.8%.

This method doesn’t take into account a range of other expenses and costs associated with managing an investment property. This can lead to some inflated figures which might lead investors to believe a property will be more profitable than it is.

How to Calculate Net Rental Yield?

This is a more accurate indicator of a property’s likely rental return which takes into account the expenses and costs associated with managing the property to provide a more realistic figure. The formula for net rental yield is:

(Annual rental income – annual expenses) x 100

Price of the property

Before you can calculate the net rental yield, you will need to know or estimate what the property’s annual expenses are. Typical investment property annual expenses include:

- Insurance premium costs

- Property management fees

- Interest from loan

- Vacancy costs

- Maintenance costs

- Council and water rates

- Body corporate or strata levies

The annual expenses can be calculated by adding together all of the above costs that apply to a property. This means that if a property generates $1,500 per week in rent, has an annual expense of $17,000, and is advertised for sale at $1,000,000, the gross rental yield is as follows:

- Multiply $1,500 by 52 (weeks) to get the annual rental income which is $78,000.

- Next, minus the annual expense of $17,000 from $78,000 = $61,000

- Then divide $61,000 by the price of the property which is $1,000,000 = 0.061.

- Finally, multiply 0.061 by 100 to get the percentage, this gives us a net rental yield of 6.1%.

As you can see, there is a significant difference between the results of both methods of calculation. While the gross rental yield is 7.8%, the net rental yield of 6.1% is a more accurate figure allowing investors to make data-driven decisions and compare options.

Gross Rental Yield vs Net Rental Yield?

The net rental yield is more important for investors to consider as it provides a more accurate picture of a property’s likely rental return. It considers everything it costs to keep that property up and running as well as any interest that may be required to pay on loans and mortgages.

It is important to note that the net rental yield calculation only includes expenses that are pertinent to the property. This means that costs associated with mortgage interest charges, taxes, and other expenses related to the individual owner’s financial situation are not included.

What is a Good Rental Yield?

There is no industry-standard rental yield percentage that is considered ‘good’. But the general rule of thumb is the higher the rental yield, the better it is for investors looking to improve their cash flow.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

“A high cash flow where all the income takes care of all the expenditure gives you serviceability, which gives you time in the market because you’re not at the mercy of high-interest rate and market fluctuations.”

However, a high rental yield doesn’t always translate to higher returns. A remarkably higher rental yield (between 8-10%) could mean that the property is undervalued or below market value. While a significantly lower rental yield (between 2-4%) can mean that it is overvalued.

The Commonwealth Bank of Australia advised aiming for rental yields of 5.5% or higher as this represents a relatively stable rental income.

Is a Low Rental Yield Bad?

Although properties with high net rental yields are ideal, this doesn’t mean that properties with low net rental yields are bad investments. Investors looking for long-term capital growth with a buy-and-hold strategy may benefit from properties with low net rental yields.

“If you’re holding $2 million in assets, an annual rise of 5 per cent in value translates into $100,000 in the first year which continues to compound as the property price cycle runs its course.”

However, for this investment strategy to work, investors will have to establish a steady cash flow stream to sustain the portfolio during periods of low-cash flow.

How Rental Yield Affects Your Investment Property?

Understanding how property yield works will be helpful when it is time to review the rent on an investment property. It can also be helpful when evaluating a property’s investment potential in comparison with other properties in the same area.

Although it is tempting to focus on the gross rental yields because it is easier to calculate, it can be misleading when comparing different investment properties. To get an accurate picture of your property investment yields, you should focus on its net rental yield.

Is it Possible to have Both Good Rental Yield and Good Capital Growth?

Yes, it is possible to find a suburb with both good rental yield and good capital growth. However, this can be quite rare as most locations are usually geared for one or the other. In most cases, you will be required to choose between one or the other for your investment property.

At first glance, investing in a property with strong capital growth seems an obvious choice. However, rental yields on properties like these tend to be almost always negatively geared. This means that expenses almost always exceed the rent earned.

On the other hand, properties with higher rental yields are usually positively geared investments where the rent exceeds all costs. So, when the time comes to sell, the capital gains are likely to be less than that of properties with strong capital growth.

What other Data should you Combine Rental Yield with when Looking for the Best Suburbs to Buy Investment Properties?

Although an important real estate data, the rental yield does not provide a holistic picture of the investment potential of a suburb.

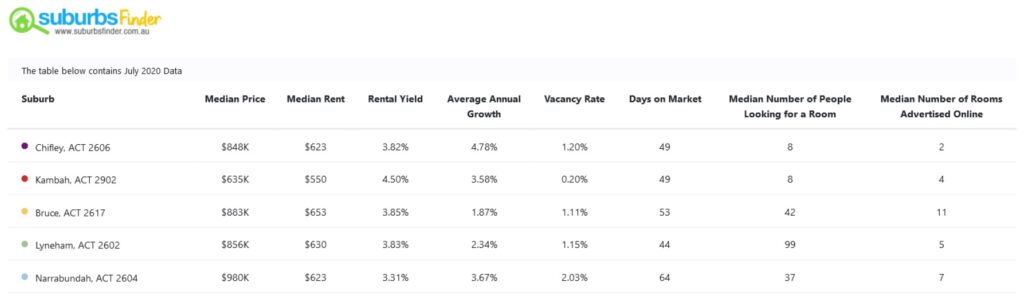

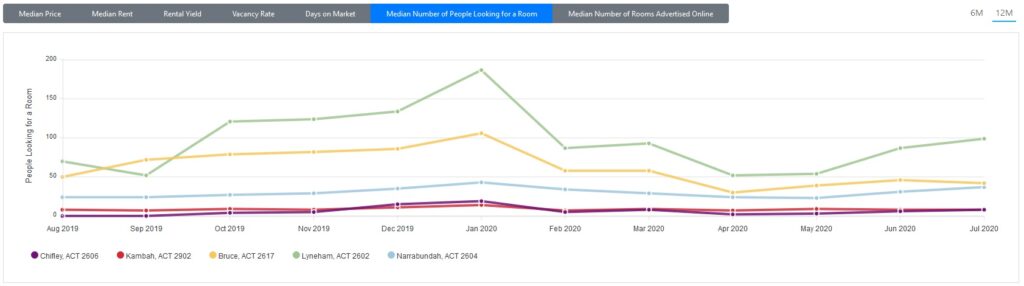

For example, knowing the rental yield of a suburb doesn’t tell you the vacancy rate or days on market for properties in that suburb which will provide you with more insight on your potential ROI. Other important real estate data points to consider when searching for the best areas to buy investment properties include:

- Days on Market

- Vacancy Rate

- Capital Growth

- Household Income

- Rental Listings (Rental Stock)

- Sale Listings (Stock on Market)

- Online Search Interest/Demand

- Median Price

- Percentage of Owner and Renter

It is important that you carry out your research and due diligence when planning to invest in property. Combining these different real estate data points will provide the best insights for data driven investment property decisions.

Our fully customisable tool will help you in choosing which areas have both Good Capital Growth and Positive Cash Flow. It lets you narrow down 15,000+ suburbs by combining all 40 data points as filters. It also lets you compare suburbs’ historical & current performance. And once you have identified the best location, it also lets you do feasibility studies on 5 properties all at the same time. Thereby saving time, budget, and covering the full cycle of your investment property research workflow

So, if you think what we’ve built will drastically decrease your time researching for the best location and finding the right property based on your goals and financial situation, sign up for free and give it a try now!

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcode. It’s the perfect tool for property investors looking to buy a property.