Finding the right suburb to invest in has never been more complex. With property prices and rents holding steady in many of Australia’s major cities, the margin for error has tightened. The challenge isn’t just where to invest—it’s when and why. And for those chasing short-term gains, timing is everything.

The truth is, very few investors can consistently pick winning suburbs at just the right moment. Even when their assumptions are correct, they often enter too late—after the market has already peaked. That’s because by the time the media labels a suburb a “hotspot,” the growth story has already been written.

So how do you identify the next hotspot before it’s common knowledge? That’s what we’re diving into.

The Secret to Building a Scalable Property Portfolio

Ask any seasoned investor how they built wealth, and you’ll hear a common theme: leverage.

You start with one property. Use the equity growth from that to buy your second. Then use those two to leverage into a third—and the cycle continues. The magic lies not in a single deal, but in compounding value across multiple properties.

But here’s the catch: if you buy in the wrong suburb, with little to no growth, your entire strategy stalls.

That’s why identifying growth suburbs early—before they peak—is absolutely crucial.

What Is a Property Investment Hotspot?

A hotspot isn’t always a glamorous or trendy neighbourhood. In fact, most emerging hotspots are overlooked.

Typically, they’re:

- Undervalued suburbs near well-established blue-chip areas

- Locations undergoing gentrification or urban renewal

- Affordable alternatives to neighbouring suburbs that have already boomed

These areas benefit from what’s known as the ripple effect—when buyers priced out of one suburb turn to the next best thing nearby, pushing up demand and prices.

Why Most Investors Get It Wrong

Many property buyers in Australia rely heavily on media headlines, auction clearance rates, and median price data.

But here’s the problem:

- Auction clearance rates fluctuate wildly and often reflect only a small sample of the market.

- Median prices can be skewed by a few high or low sales and don’t tell you what’s coming next.

Instead, savvy investors dig deeper. They use forward-looking data to uncover suburb trends before they appear in the news.

The Real Estate Data That Actually Matters

To identify future hotspots, focus on these leading indicators:

Sales Volume Trends

An uptick in sales volume is often the first clue that demand is rising. Price growth usually follows.

Example: In Sydney and Melbourne, sales activity surged long before price increases showed up in 2018 and again in 2021.

Tip: Look for suburbs where transaction numbers have been steadily climbing quarter over quarter.

Consistent Price Growth

Watch for steady increases in house prices over 1–3 years—not a one-off spike.

This suggests organic demand, not hype-driven buying.

Falling Days on Market (DOM)

The faster properties are selling, the hotter the demand.

If homes in a suburb are getting snapped up quicker than usual, that’s a strong buy signal.

Just remember—DOM can vary by area, so always compare against the suburb’s historical average.

Rising Rental Yields

Yield is your property’s annual rent as a percentage of its value.

When yields are climbing, it typically means:

- Rents are going up

- Property prices haven’t yet caught up

- Rental demand is strong

All signs of a suburb on the rise.

Low Vacancy Rates

A suburb with a <2% vacancy rate is seeing strong rental demand.

Tight rental supply often precedes capital growth, as more tenants become buyers, increasing competition.

Infrastructure Projects and Job Creation

New roads, schools, train stations, hospitals—these aren’t just convenient. They boost liveability, attract new residents, and ultimately push up property values.

The key? Focus on committed infrastructure (i.e. already funded and underway), not just proposed projects that may never happen.

How to Identify Hidden Gems Before They Boom

1. Compare Median Prices Across Borders

Let’s say Suburb A has a median price of $1.2M, and the adjacent Suburb B sits at $900K.

If both have similar lifestyle benefits and amenities, Suburb B may soon follow A’s lead.

A price gap of 5%–10% between neighbouring suburbs often indicates a ripple effect is imminent.

2. Focus on the Property, Not Just the Postcode

Yes, buying in a growth area matters—but the individual property still has to stack up.

Look for:

- Unrenovated homes with value-add potential

- Properties priced below market value

- Proximity to transport, schools, and shopping

- Zoning changes that allow for development or subdivision

3. Look for Gentrification Markers

Gentrification transforms underperforming suburbs into high-demand hubs.

Key indicators include:

- Influx of young professionals or creative types

- New cafes, boutiques, and restaurants opening

- Renovated homes replacing older stock

- Shift in demographics (higher incomes, lower unemployment)

Check census data, business openings, and lifestyle changes on the ground.

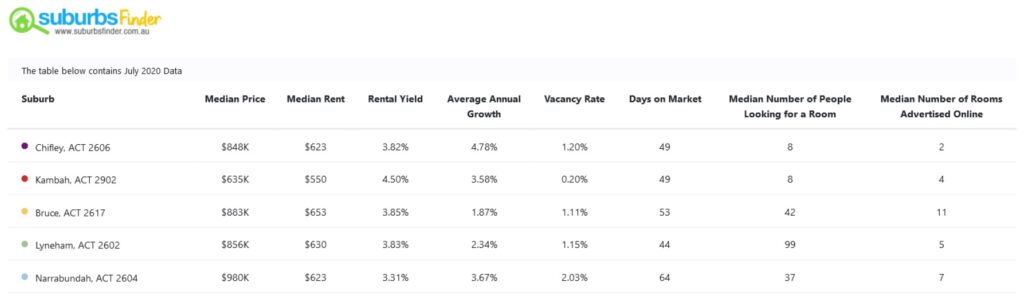

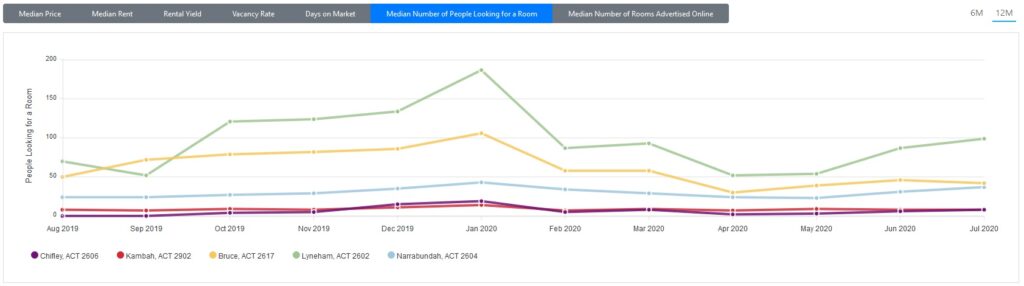

How SuburbsFinder Helps You Find Hotspots in Seconds

Manually gathering this level of suburb data is time-consuming. That’s where SuburbsFinder comes in.

Our tool allows investors to:

- Filter 15,000+ suburbs by 40+ growth and yield data points

- Instantly spot suburbs with rising sales volume, rental yields, and capital growth

- Compare suburbs side by side to evaluate which has the strongest investment fundamentals

- Run feasibility studies on up to 5 properties at once

🔗 Watch: How to Find High Growth Suburbs in Seconds Using SuburbsFinder

Whether you’re after capital growth, positive cash flow, or both, our platform helps you stay ahead of the curve.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

What to Know Before Buying in a Hotspot

Before you jump into an emerging market, keep these points in mind:

Look for Unrenovated Value

Buying a well-located property in original condition lets you manufacture equity through renovation.

Understand Local Market Value

Don’t just assume a lower price means a good deal.

Compare similar recent sales to make sure you’re buying under or at market value—not overpaying due to emotion or urgency.

Identify Instant Growth Potential

Properties in suburbs showing signs of gentrification, new developments, or ripple effect movements will often yield quicker returns.

But remember: capital growth takes time. Avoid betting everything on short-term flips unless you’re experienced in renovations or developments.

Data-Driven Property Investing Wins

There’s no magic crystal ball in property. But by using real estate data and understanding the property cycle, you can confidently identify suburbs on the cusp of growth—before everyone else does.

That’s how smart investors stay ahead.

Ready to Find Your Next Hotspot?

SuburbsFinder helps you:

- Identify suburbs with both capital growth and positive cash flow

- Compare historical and current suburb performance

- Run instant feasibility checks on shortlisted properties

With over 15,000+ suburbs across Australia and filters for every critical data point, SuburbsFinder is the all-in-one platform for smart investors.

It’s perfect for those looking to rent by room, renovate for equity, or buy and hold long term—and ensures you’re always investing based on data, not guesswork.

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcode. It’s the perfect tool for property investors looking to buy a property to rent out rooms individually to have a positively geared portfolio.