There is considerably more to cash flow positive property than you think.

Positive Cash Flow Investment Property is the type of property that pays you every week just by owning it. Wow! Great, right?!

The expected benefit of positive cashflow property is that it is not too much of a burden on your regular home income, but truth to tell, it is the opposite.

It is certainly an advantage to get an annual income from your property. But do not forget that you could most likely make a capital gain as the property’s value grows during the period you are holding it.

Definitely a win-win situation to no end!

What is a ‘Positive Cashflow Investment Property’?

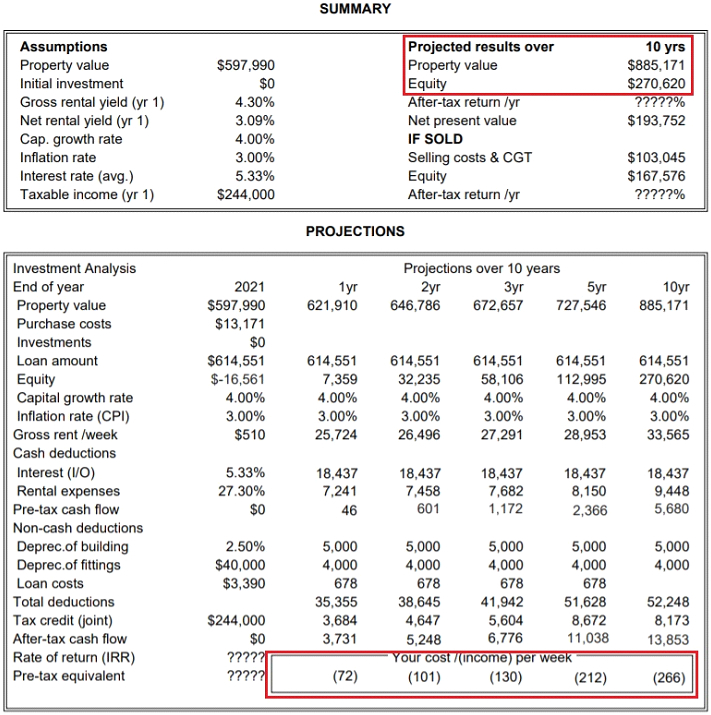

EXAMPLE: Below is one illustration of one investment financial model for a property. The conclusion for the case is that this is what a strong cashflow positive property looks like.

(NOTE: This example is for illustration purposes only as there are several factors to choose from as you select the right property. Your circumstances may not be the same with this investor).

Let’s discuss this example further:

- $597,990 = purchase price

- $510 = gross rent per week, or $25,724/year after applying a 3% vacancy rate.

- For Year 1 = $18,437 is the loan interest; other rental expenses = $7,241, with $46 pre-tax cashflow.

- BUT: Note that for Year 1, there are additional non-cash deductions, such as the depreciation of the building and fittings and loan costs, which add up to the total amount of $9,000. These non-cash-deductions qualify as tax deductions. They can be legally claimed even though you didn’t take out any cash from your pocket.

- $25,724 = total income and with $35,355 in both cash and non-cash expenses, the so-called “on-paper loss” is $9,631 for Year 1.

- The investor can claim $3,684 back for taxes on the on-paper loss.

- Lastly, for Year 1: $3,731 (or $72 per week) = after-tax cash flow of this property.

YES – Positive Cashflow is Increasing Over Time…

Increases in the rental as well as other factors were considered in the model.

Positive cash flow will INCREASE steadily through the years.

| Year 1 | $72 per week in positive cashflow. |

| Year 2 | $101 per week in positive cashflow. |

| Year 3 | $130 per week in positive cashflow. |

| Year 4 | $212 per week in positive cashflow. |

| Year 5 | $266 per week in positive cashflow. |

*For some, $72, $101, or maybe $266 per week may seem not a great deal of money which will at least make you richer but note that these cash flow numbers are all considered “money-in-the-pocket” after ALL expenses have been paid out.

As you are gaining CASH, the property is appreciating in value.

With this model, this property will collect $270,620 in EQUITY within a 10-year timeframe.

(Not a bad yield considering this property is profitable to keep holding every year along the way!!!).

You now get a clearer picture of how this Positive Cash Flow Property works so let’s look at how this approach varies from the other somewhat confusing terms – gross & net rental yield.

Definition of Rental Yield

Rental yield measures the amount of cash an investment property earns each year as a percentage of the property’s value.

Rental yield can be calculated as either one of the following:

- gross percentage i.e., before deducting the expenses, or

- net percentage i.e., with costs all accounted for.

The gross rental yield is a simpler calculation as it does not consider the property’s expenses.

The Formula for Gross Rental Yield

(Weekly rent x 52) / Property purchase price x 100

A property may have a high gross yield but then also have huge costs, thus, the resulting net yield may be low when such costs are considered.

You may use this formula to work out the net rental yield, but you will need need to know the total property’s expenses.

The Formula for Net Rental Yield

(Annual income – Annual expenses) / (Total property costs) x 100

Strategies to find Positive Cashflow Properties

There are several strategies to achieve positive cashflow properties and also how to manage these properties to help increase the cashflow.

Some of these are:

- Checking in high-yielding suburbs.

- Purchasing properties at about 20-40% below the median price for the suburb.

- Looking for multiple income properties – like those with a granny flat.

- Buying in regional areas and prioritizing student accommodations.

- Adding value by doing renovations and making improvements to increase rent.

- Managing interest rates and fixing it in case the current interest rate is at the bottom of its cycle.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

Top 5 Advantages of Cash Flow Positive Property

Acquiring the right positive cash flow property can have many benefits for the investor:

- Self-Standing: Positive cash flow properties pay for themselves without requiring you to shell out money regularly.

- Scalability: This extra cashflow allows you to create a portfolio of investment properties whereby you will find yourself investing in more than one property at a time

- Realize goals quickly: Positive cash flow properties enhance your income; thus, you can buy your next property sooner.

- Decreased Cash Flow Risks: Positive cash flow properties are stand-alone properties whereby if something unexpected were to happen to your main source of income, you would still be able to keep it as it is paying for itself. Unlike negatively geared properties where it is costing you money to hold, a reduction in your income might force you to consider selling immediately your negatively geared property.

- Double Win Effect: Positive Cashflow properties allow you to have weekly cash flows, while gaining capital growth at the same time. Majority of investors favour this kind of strategy.

What are the risks and pitfalls to avoid?

Investors perceive that targeting positive cash flow property is quite a lucrative strategy. But as with all investment strategies, execution is key.

It is better not to invest at all rather than buying the wrong type of positive cashflow property.

BE aware of these risks/traps:

- Check the Properties tagged as “High Risks”: Several properties like hotels, serviced apartments, or vacation houses may generally show a strong positive cash flow only “on record.” But the fact is that often, these properties don’t have a robust growth forecast.

- Good Growth Outlook: Having $25 or even $150 money-in-your-pocket every week is good, but only if growth is also an integral part of the equation. We recommend targeting those suburbs and properties that have strong and solid growth fundamentals.

- Watch out for the Unnecessary Extras/Add-ons: Watch out for the unnecessary add-ons or extras like “sweeteners” to the deal, especially the clauses that come with it. Take limited rental guaranteed rates for example that make the property cash flow positive (but only if the rental guarantee rate is applied). Consider checking what the typical rental market will pay once the guarantee expires. More importantly, ask why this rental guarantee is being offered in the first place.

- How is Positive Cashflow Calculated: Take note of where the positive cash flow is derived. Is the property cash flow positive before tax (after cash deductions have been applied) or only after the non-cash deductions such as depreciation have been applied? You should be cautious if the positive cashflow is largely derived from the significant depreciation applied.

- Is the Depreciation claimable? The depreciation of fittings and fixtures is claimable only when you are the FIRST owner of the property. You can claim if you’re buying a new property. You can never claim these deductions if you’re a subsequent owner of the property.

- Are Interest Rates important? For property investors, bank interest is generally a major priority when it comes to expenses. Take note that when interest rates accelerate at a higher pace, your positive cashflow property may turn into either one of these: negatively geared or neutrally-geared property. Thus, it is practical to anticipate increases in interest rates in your models as well as consider fixing your interest rates for a certain period when interest rates are low.

- Assumptions should be cleared: Financial models are only as valuable as the assumptions and inputs that were considered. So, if you are pushing for a certain amount of rent, conduct due diligence to ensure that the desired rent is realistically achievable. And if aspiring for growth, ensure that the appropriate growth drivers are evident in the suburb’s information and historical data.

Investor awareness of the potential risks is also recommended and should be inherent in the investor’s due diligence process always.

Never allow such risks to defer or put on hold your actions (as the expense of not acting may be substantial). When making rational decisions, it is important to do your homework.

Where to find the Positive Cashflow Properties?

Positive cashflow properties can be quite challenging to find. The conventional cashflow properties typically have had one or two of the following attributes:

- Located far away from capital cities (i.e., in regional/rural areas)

- Higher rental yield (for effective loan serviceability)

- Cheaper/Lower purchase price

- Lower capital growth

- Categorized as high risk type of property (like holiday units, in mining towns, etc.)

The current Australian property market though has changed in a way that benefits the knowledgeable investors with strong real estate fundamentals as they know where to look.

Thanks to extensive access to property information, good interest rates and several other platforms. Finding positive cashflow properties is now possible…

- In key population centres or capital cities;

- With high growth potentials based on strong high demand vs. supply;

- With stronger security as there’s largely economic group diversity for the key cities or population centres.

To put it simply, high-quality and worthy positive cash flow properties are now being offered in areas that have growth potential.

Due Diligence Checklist for Positive Cash Flow Properties

Nowadays, we have access to as much up-to-date property information available. Finding data is no longer an issue like it used to. Interpreting the data is now the problem! And taking the proper action required based on the interpretation.

For instance, many will check the historical data such as median price growth over the past year. Though such is helpful, it just generally provides you information on what has already happened in an area.

If you are looking for cashflow positive potential options, we do need to consider such factors. But more importantly, study the trends that will influence property prices such as:

Economic Growth: A strong economy that is growing produces job opportunities. This drives people to an area, thereby, boosting the demand for housing. And applying the ‘law of supply and demand’, consequently, both property rents and prices go up when there is an increase in demand.

Surrounding Suburbs: A suburb that’s close to more expensive suburbs usually experiences higher growth, as attested by the phenomenon called the “Ripple Effect.” What we usually look for are locations that will benefit from the higher prices in neighbouring suburbs.

Inadequate Supply: When supply is limited but demand is high, price accelerates so the prices for houses nearby the major centres (where land is limited or scarce) tend to increase more vs. the small cities or rural towns where land is in abundance.

Rental Yields: Cash flow is increased by high rental yields. A rental return of around 5% or more is a positive signal.

Vacancy Rates: Low vacancy rates can drive higher rental demand. This implies high rental rates and less time untenanted. A good sign of steady rental demand is a vacancy rate of 3% or less suggesting that your property will be occupied most of the time — a greater likelihood that it will not be vacant for 2 weeks or less in a year.

Valuation: While it’s a fact that the true value of a property is the price anyone is willing to pay for it, the more conservative approach is preferred as we depend on professional, independent valuations as indicative and reliable.

Recent Price Movements: If you see a suburb that has increased in price twice as much in the recent months, it is highly unlikely that it will double its price again in the immediate future. Check trends and look for suburbs that are positioned for imminent growth.

Infrastructure: We usually look for locations close to schools, universities, malls, hospitals, churches, transport systems, and other desirable developments, as these local amenities have a strong influence on vacancy rates and rental prices. Even better are locations where an infrastructure is poised to be built and such has not yet been factored into the local property market values.

Potential Tax Benefits: Depreciation can have a significant role in the cash flow equation. That’s why it is important to evaluate every positive cash flow property opportunity from all angles, and consider all the factors such as price, structure, individual property and funding in the equation.

If you can fulfil all the above criteria, then it’s highly likely that you’re looking at a property that will do remarkably well in your portfolio, both in the medium and long term.

Have you been captivated on what cash flow positive properties offer? Great! Start taking action now!