One of the biggest deductions on a property investment available is tax depreciation. But not all property investors are aware of this and may not even order a depreciation schedule when purchasing a property. Through the years, many didn’t know that this property tax depreciation exists at all. Or some have falsely believed that this is not valuable for their property, or their accountant can just do it for them. They might have done it even for themselves, while claiming the deductions at the same time. All these views and actions could often lead to non-compliance in Australian Taxation Office’s (ATO) laws and worst, amounting to thousands of dollars in missed deductions.

One issue though these investors usually ask if ever their property is put on sale is on how it will affect their Capital Gains Tax (CGT)?

It may seem that Capital Gains Tax is pretty difficult to understand, more so if you take into account the various consequences of property depreciation and discounts.

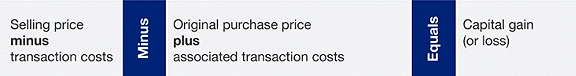

CGT was established in 1985 offering a tax payable on the difference of the cost the property was bought for and the selling price. Selling the property is like fuelling a CGT activity suggesting either of these two results: a capital gain or a capital loss, which can be calculated as follows:

Definition of Capital Gains Tax

When one pays tax on the profit or more aptly called as “capital gain” that you benefit from selling the investment property, this is termed as the Capital Gains Tax (CGT). The term capital gain means the difference resulting between the price you paid for the property (cost base) and the price it was sold for. This is taxed at your marginal rate and forms part of the assessable income in your annual tax return.

At this point, you might be asking, “What is net capital gain?” This is the difference of the total gain and your total loss for the same financial year. This may also include any past net capital losses as well as CGT concessions or discounts which have not been applied yet.

What you Need to Know about Property Depreciation?

Property depreciation refers to the building’s wear and tear on the structure and the plant and equipment components that came with it. With guidelines set by ATO– this means that those who have income-generating properties can make claims for depreciation via annual tax return deductions. Or to put it simply, the tax to be paid is less. The property depreciation consists of deductions for these two primary divisions: capital works and plant and equipment.

How to Compute for Depreciation Deductions in your Investment Property

Our Tax Depreciation Calculator powered by MCG Quantity Surveyor assists you to have an estimate of the expected deductions for depreciations. This can be claimed for all properties such as commercial, residential and manufacturing buildings.

How does Capital Works Deductions affect CGT?

As mentioned, for the building’s wear and tear – capital works deductions are available. Take into account the following things which normally deteriorate through time: roofs, ceilings, tiled floors, windows, tiles, doors, sinks, cabinets, cupboards and power or electricity cabling. These capital work deductions decrease the base cost of the property, thereby increasing its capital gain and the amount of CGT applicable on sale.

How does Plant and Equipment Depreciation affect CGT?

You can claim for depreciation deductions for the removable/transferrable plant and equipment assets within a property. But if the property is placed in a market and bought out, a gain or loss is computed separately for such items. With ATO’s guidelines, it works this way: you get a capital gain if the depreciating asset’s termination value is higher vs. its cost. Conversely, you incur a capital loss where the termination value is smaller than the cost of the asset.

Are Property Investors Entitled to a Discount?

Yes, in fact – a 50% exemption on CGT is being offered to both individual and small business owners who keep the investment for more than 12 months based from the date the contract was signed prior to the sale date.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

What Exemptions in CGT are Valid for a Primary Residence?

Those who own properties and reside, occupy or live on their property as their home are exempted from CGT provided that the building or structure is primarily used as a residential dwelling situated on a less than two-hectare land.

In another scenario: If one who owns a principal residence opts to leave home and have it rented, there is exemption for CGT. This leads up to six years of the transfer. For you to be eligible – this means you should not own another main dwelling/structure as residence.

However, once the owner returns to occupy his investment property and then leaves and gets back to rent the property again, it’s a different story. A new six-year period will start from the time the owner last moved out from the property.

The fact is that there is no limit as to the number of instances a property owner can do this arrangement as long as each absence is less than six years. Is this clear? Got it?

The rule is that you can only categorize one property as being a ‘primary place of residence.’ Hence, this is allowed for exemption from CGT at any one time, except for these conditions below if you’ve considered both properties as your foremost residence in a six-month duration:

- The new property turns out to be your primary place of residence.

- The last property has been your main residence continuously for not less than three months during the one year before it was sold. Also, as owner – you have not allowed the property to get measurable income in any way during the one year when it was not identified as your primary place of residence.

How does Depreciation Help Property Investors?

If you are a residential investment property owner, the amount of claims for depreciation deductions you can maximise certainly makes a positive contribution in your cash flow. In fact, the ATO lets those who own the income-generating properties acquire depreciation deductions for the wear and tear that happens to both building and physical assets through the years, depending on the date of construction and acquisition.

Do you know that any property that provides income may be entitled to depreciation deductions for thousands of dollars? The tax depreciation schedule ensures that every deduction is recognized and applied for.

A Quantity Surveyors Tax Depreciation Schedule includes all existing deductions throughout the property’s lifetime. It provides accountants with relevant information to compute the capital gain tax or loss. It has a one-time charge and is 100% tax-deductible.

Is it Advisable to Claim Property Depreciation even if it is Added to the Capital Gain?

Yes, it is. While you own the property, you can claim both for plant and equipment and capital works as deductions at your marginal rate. Such deductions are meant to reduce tax liabilities resulting to additional cash flow on a yearly basis to you as an investor. Crunching these figures may mean you could be in a better situation on claiming continuing deductions for depreciation while the property is in your possession.

Let’s study this illustration:

CASE STUDY: How to Claim Capital Costs?

In 2016, John bought out an investment property for $550,000. He then asked MCG Quantity Surveyors to check and estimate the original cost of construction since this was not provided in the settlement. The quantity surveyor estimated that the original cost of construction was at $190,000, of which $175,000 is on building allowance. For various reasons, John reluctantly decided to sell the property in 2021 for $700,000 (after all the deductions associated with selling the property). To add, while the property is owned by John – he had already claimed $17,500 in building allowances.

The following computations will show how we came up with the capital gains tax liability:

- Purchase price of investment property – $550,000

- Sale price after deducting selling costs – $700,000

- Gross capital gain – $150,000

- Add building allowance claimed – $17,500

- Total CGT liability – $167,500

- CGT liability after 50% – $83,750

- CGT payable at John’s marginal rate of 45% – $37,688

- Overall profit after CGT – $112,312

By adding the building allowance claimed to the CGT calculation, John added $3,938 to his capital gains payable (i.e., $17,500 x 50% * 45% = $3,938).

(Take note that any property held for more than a year benefits from the 50% CGT tax discount).

BUT THEN: John also had the benefit of claiming that $10,000 off his marginal tax rate, saving him with this: $10,000 x 45% = $4,500.

Lastly, John claimed over $12,500 in plant and equipment deductions. These deductions supposedly have no weight on the CGT computation as they’re presumed to be sold at the written value (if not stated in the contract).

Thus, John saved more: $12,500 x 45% = $4,500.

John was very pleased that he had prepared a depreciation schedule.

MCG Quantity Surveyors find an average 1st year deduction of $9,249.5*. If you need information, you may ask a quotation or talk with one of their expert teams at MCG Quantity Surveyors Tax Depreciation on 1300-795-170.

Checkout MCG 1,000 Assets Study 2020