Positive Cash Flow vs. Negative Gearing: Which Strategy Suits Your Property Investment Goals?

When investing in real estate, one of the most important decisions is whether to pursue positive cash flow or negative gearing. This choice significantly impacts your income, tax position, and long-term wealth-building strategy. In this guide, we’ll explain the differences, weigh the pros and cons, and help you decide which path aligns best with your investment goals.

What Is Positive Cash Flow?

Positive cash flow refers to an investment property that generates more income from rent than it costs to own. These costs include:

- Mortgage interest

- Property management fees

- Insurance

- Repairs and maintenance

- Council rates

If the rent covers these expenses and leaves a surplus, your property is cash flow positive. This strategy allows you to build wealth while receiving a passive income stream.

Advantages of Positive Cash Flow:

- Generates income from day one

- Easier to manage financially (less need to subsidise the property)

- Improves borrowing capacity and serviceability

- Offers flexibility to reinvest or pay down debt

Disadvantages of Positive Cash Flow:

- Higher taxable income due to surplus revenue

- Often found in regional areas with slower capital growth

- Limited long-term wealth creation if property value stagnates

Which Strategy Is Better?

It depends on your financial goals, income, risk tolerance, and investment timeline.

- Choose positive cash flow if you want regular income, have lower risk tolerance, or need the property to pay for itself.

- Choose negative gearing if you’re focused on long-term capital growth, have surplus cash flow, and want to maximise tax benefits.

Use Data to Guide Your Strategy

With our Investment Property Feasibility Tool, you can:

- Compare up to 5 properties side-by-side

- Analyse both cash flow and capital growth potential

- Run quick feasibility studies using 40+ filters

- Identify suburbs with strong performance history and positive rental returns

This tool helps you make confident, data-backed decisions, whether you’re buying for yield or growth.

🎥 Watch: How to Find High Growth Suburbs in Seconds

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

What Is Negative Gearing?

Negative gearing means your property costs more to hold than the rental income it generates. You’re making a short-term loss in the hope of long-term gain through capital growth.

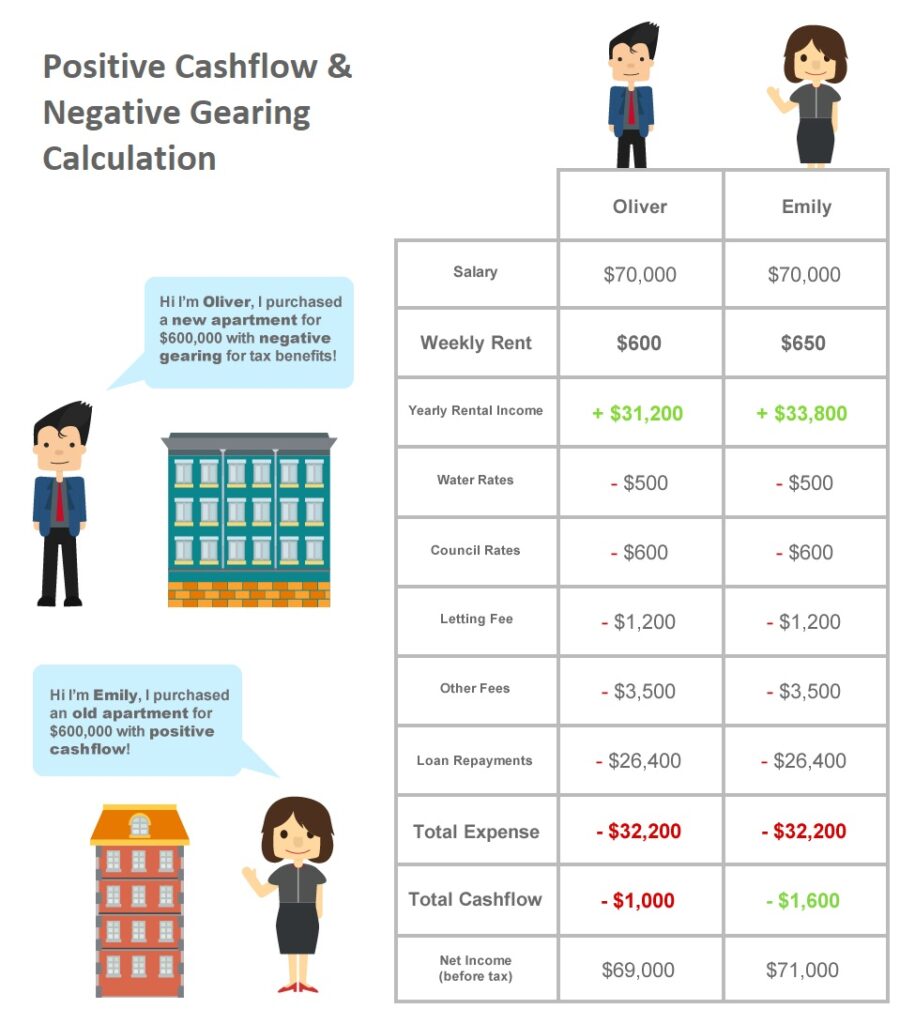

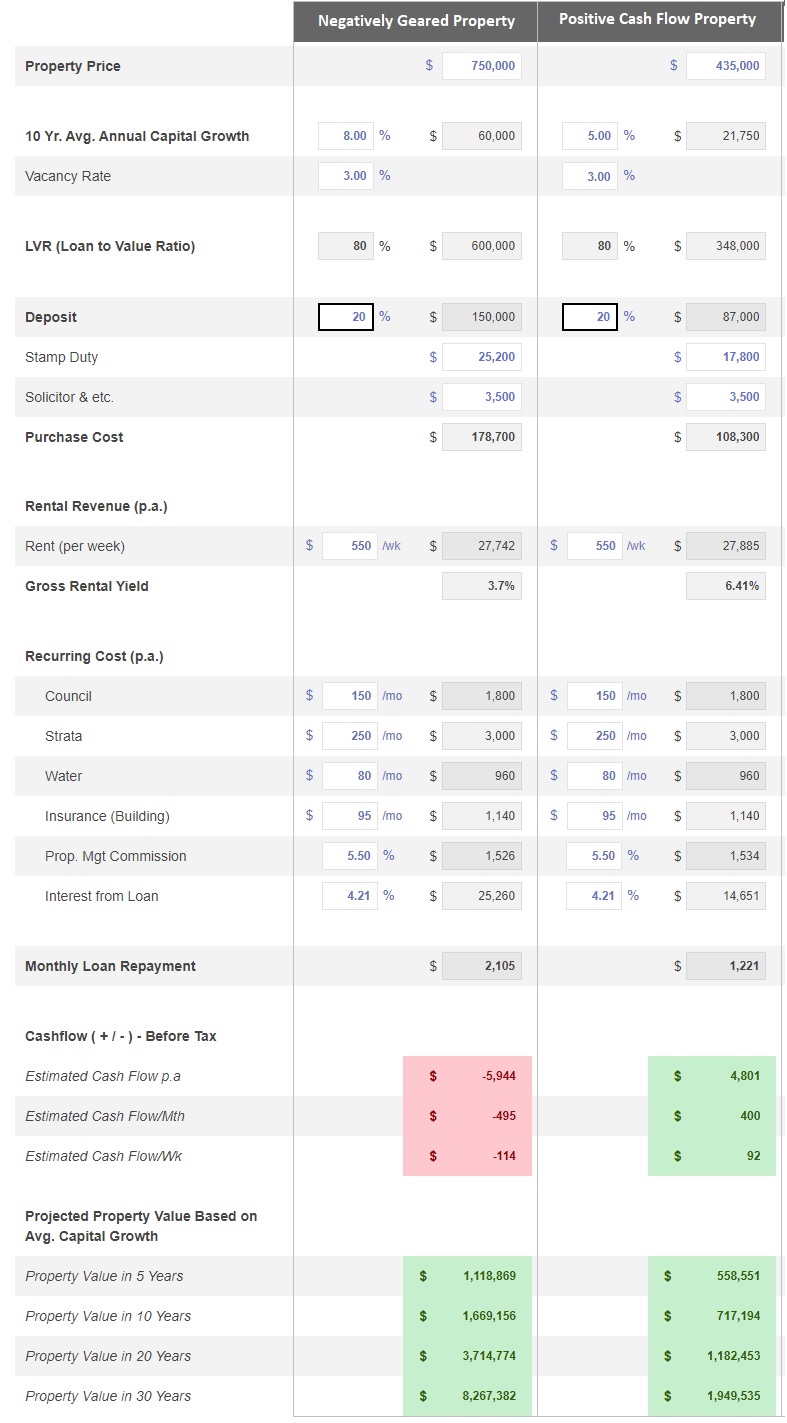

For example, if your property earns $19,200 in rent annually but costs $25,000 to hold, your annual loss of $5,800 could be offset by tax deductions and future property value increases.

Why Would Investors Choose Negative Gearing?

- Tax deductions on interest and holding costs can reduce taxable income

- A long-term focus on capital growth outweighs short-term losses

- Many high-demand metro properties fall into this category

Advantages of Negative Gearing:

- Potential for high long-term capital gains

- Significant tax benefits on investment losses

- Ideal for high-income earners seeking wealth creation over time

- Opportunity to build equity for future investments

Disadvantages of Negative Gearing:

- Requires strong cash reserves to cover holding costs

- Limited short-term income

- Riskier if the property doesn’t grow in value as expected

- Increased exposure to interest rate changes

Key Questions Answered

1. Why invest in a negatively geared property?

Negative gearing offers strong tax incentives and long-term capital growth potential. If you have the financial capacity to absorb short-term losses, this can be a highly effective wealth-building strategy.

2. Why not always choose positively geared properties?

While they offer immediate returns, positively geared properties often sacrifice capital growth. Most are found in lower-demand regional markets with limited long-term value increases.

3. What type of property should I buy?

Let your financial position and goals guide you. If you’re just starting and want a safer, income-producing asset, positive cash flow might suit you. If you’re in a strong financial position and prioritise equity growth, negative gearing could be a better long-term strategy.

To make matters easier for investors we’ve created an Investment Property Feasibility Tool that lets you compare up to 5 properties at the same time to help you identify and pick the best investment property that fits with your investment goals, investment strategies (positive cashflow or negative gearing), and financial capacity.

The example numbers above show how negatively geared properties are more beneficial in the long run when compared to positively geared properties.

There are a few key messages that we would like to deliver here. When investing in real estate, you are either looking for growth or you are trying to make an earning out of it. Whether these investments are positively geared or negatively geared is a separate topic altogether. The best advice we believe we can give you is not to after every glittery and shiny thing you find in the market. When buying a property, we believe proper research and calculation is the key to your success. We would also like to add that it is absolutely possible to have a good cash flow and capital growth simultaneously, by using proper researching tools like SuburbsFinder.

Our fully customisable tool will help you in choosing which areas have both Good Capital Growth and Positive Cash Flow. It lets you narrow down 15,000+ suburbs by combining all 40 data points as filters. It also lets you compare suburbs historical & current performance. And once you identified the best location our tool also lets you do feasibility studies on 5 properties all at the same time. Save time, budget, and cover the full cycle of your investment property research workflow

So, if you think what we’ve built will drastically decrease your time researching for the best location and finding the right property based on your goals and financial situation, why don’t you sign up for free and give it a try.

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcode. It’s the perfect tool for property investors looking to buy a property to rent out rooms individually to have a positively geared portfolio.