Where and How to Find the Best Suburbs to Buy Investment Property in Australia

The Ultimate Formula:

7%+ Capital Growth | 6%+ Rental Yield | <2% Vacancy Rate | Strong Demographics

When buying an investment property, your primary goal is capital growth and rental income—not lifestyle preferences like proximity to your workplace. That means your suburb selection needs to be strategic, data-backed, and focused on long-term financial outcomes.

In this guide, we’ll walk you through the core reasons why property investing remains one of the best long-term wealth-building strategies in Australia, what to look for in a suburb, how to balance capital growth and cash flow, and how to shortcut the research process using data-driven tools.

Why Property Investment Remains a Smart Long-Term Strategy

Even in the face of market fluctuations in cities like Sydney and Melbourne, property continues to be one of the most trusted and tax-efficient ways to build wealth in Australia.

Here’s why:

- Historically strong returns: Residential property has delivered above-average returns when compared to other asset classes.

- Consistent long-term capital growth: Australian real estate markets have demonstrated resilience and growth across decades.

- Ongoing demand: Australia’s population growth and shrinking household sizes are fuelling long-term housing demand. BIS Oxford Economics forecasts that 620,000 new households will be needed nationally by 2030.

- Tax advantages: Investors can benefit from negative gearing and capital gains tax discounts—powerful tools for both middle-income and high-income earners to reduce their taxable income.

Pros and Cons of Investing in Property

| Pros | Cons |

|---|---|

| Capital growth: Grow wealth through property appreciation over time | Liquidity: Selling a property takes time, unlike shares |

| Rental income: Monthly cash flow from tenants | Upfront and ongoing costs: Stamp duty, maintenance, land tax, and insurance add up |

| Control: Full control over your asset, from tenant selection to renovation decisions | Vacancies: You’ll need to cover repayments during rent-free periods |

| Leverage: Use other people’s money (banks) to grow your wealth | Bad tenants: Damage, late payments, or disputes can hurt returns |

| Tax benefits: Negative gearing, depreciation, and expense deductions | Shortfall risk: You may need to cover the gap between rent and expenses |

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

What Are the Real Costs of Buying and Holding an Investment Property?

Upfront Costs

- Deposit: Usually 10–20% of the purchase price

- Lender fees: Loan application and establishment fees

- Lenders Mortgage Insurance (LMI): If borrowing more than 80%

- Conveyancing and legal fees: Up to $1,500

- Stamp duty: Varies by state and property type

Ongoing Costs

- Interest repayments (fixed or variable)

- Council and water rates

- Landlord insurance & building insurance

- Land tax (varies by state and property value)

- Property management fees (typically 6–9% of weekly rent)

- Repairs and maintenance

- Strata/body corporate fees (for apartments or townhouses)

- Accounting fees (for annual tax returns, especially when claiming depreciation and deductions)

Capital Growth vs. Cash Flow: Can You Have Both?

- Cash flow properties generate rental income that exceeds expenses, giving you monthly surplus.

- Capital growth properties increase in value over time, building long-term wealth.

The Trade-Off:

- High growth suburbs typically have lower yields.

- High yield areas often offer less capital growth, especially in regional or mining towns.

The Solution?

If you buy in a capital growth area, you can manufacture cash flow through:

- Renovations: Boost rental income and claim depreciation

- Granny flats or dual occupancy: Add secondary income streams

- Tax benefits: Offset losses with negative gearing

Remember: Cash flow keeps you in the game, capital growth gets you out.

What Makes a Suburb ‘Investment Grade’?

Choosing the right suburb is half the battle. Here are the key attributes of a high-performing investment location:

1. Strong Capital Growth History

Look for suburbs with:

- 5–7% annual growth over the past 5 years

- Growth outpacing the city or regional average

2. High Rental Yield

Ideal benchmark: 6%+ gross rental yield

3. Low Vacancy Rate

Indicates rental demand and property scarcity

- Below 2% = tight rental market

- Below 1% = extremely tight

4. Good Demographics

Tenants and buyers are drawn to areas with:

- Young professionals, families, double-income households

- High owner-occupier percentage (less volatility)

5. Infrastructure and Amenities

Suburbs near:

- Schools

- Public transport (train stations, bus routes)

- Lifestyle hubs (cafés, parks, beaches)

- Employment zones or upcoming infrastructure projects

6. Diversified Local Economy

Avoid areas reliant on one industry (e.g., mining or manufacturing). Look for suburbs near universities, hospitals, or major commercial districts.

How to Identify High-Growth Suburbs in Seconds

Want to find suburbs that tick all the boxes—without spending weeks on spreadsheets?

Use tools like SuburbsFinder to filter Australia’s 15,000+ suburbs by:

- Median price under $500,000

- Rental yield above 6%

- Capital growth above 5% annually

- Vacancy rate below 3%

- Demographic and lifestyle indicators

▶️ Watch: How to Find High Growth Suburbs in Seconds

Example Search Criteria for High-Performing Suburbs

- Median house price: $500,000 or less

- Rental yield: 6%+

- Capital growth: 7%+ per year

- Vacancy rate: Below 2%

- Strong demographics and job nodes nearby

▶️ Watch: How to Find High Yield Suburbs in Seconds

Finding the best suburbs to invest in property in Australia doesn’t have to be a guessing game. With a smart combination of research, data, and due diligence, you can confidently identify suburbs with high potential and secure properties that align with your long-term investment goals.

Whether you’re after cash flow, capital growth, or both—location, timing, and numbers are key. Use the tools at your disposal to make informed decisions, and never forget to run the numbers before you commit.

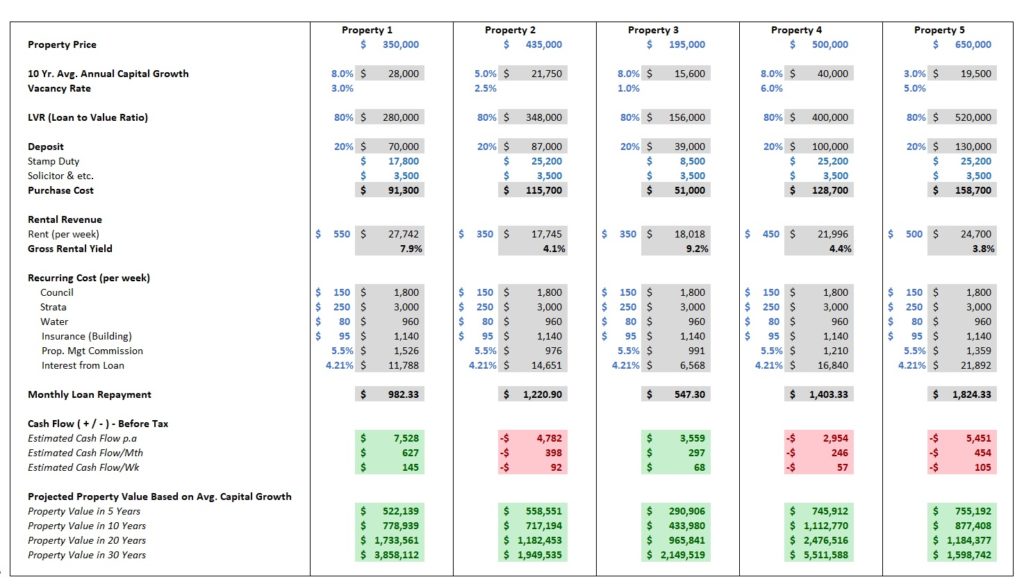

Check out our All-in-One Investment Property Calculator

The most simple and easy to use tool to calculate Rental Yield. It gives you a quick way to compare returns on different investment properties (or investments). It’s a Rental Yield Calculator, Mortgage or Home loan Calculator, Cashflow Calculator, and a Purchase Cost Calculator. It even calculates the Forecasted Property Value by Capital Growth at the same time. It’s the perfect tool for property investors, buyer’s agents, and real estate agents.