Understanding the Property Types Before You Invest

When you’re exploring strategies in residential property investment, it’s easy to get confused by terms like dual occupancy, dual key, primary and secondary dwellings, or dual living. These terms are often used interchangeably, and sometimes, incorrectly—especially in property marketing.

So let’s break down what each one really means, how they’re used, and whether they make sense as part of your investment strategy.

What is Dual Occupancy?

Dual occupancy, or “dual occ” as it’s often referred to, involves two separate dwellings on a single title of land. These homes are not joined in services, and depending on local council planning regulations, they may eventually be subdivided into separate titles—though that’s a process that requires further development approvals.

Dual occupancy is one of the most commonly used and misunderstood terms in property circles. It’s often confused with primary and secondary dwellings (like granny flats) or even dual key properties.

How to verify a true dual occupancy?

Ask for a copy of the Development Approval (DA) or Planning Permit, depending on your state. This document confirms whether you’re buying a legitimate dual occupancy property.

Primary and Secondary Dwellings Explained

A primary dwelling is your standard residential home—typically a standalone 3–4-bedroom house. A secondary dwelling, on the other hand, is commonly known as a granny flat. These can be attached or detached and are generally smaller, self-contained units built on the same title.

Here’s where it gets tricky:

Properties marketed as dual occ, dual living, or dual key are sometimes just primary and secondary dwellings, especially in places like Queensland and Victoria, where secondary dwellings often can’t be legally rented out to non-family members.

In such states, if you buy a property with a granny flat, you may not be allowed to lease it out unless there’s a family connection between the tenants. That severely restricts your ability to generate dual rental income.

Key takeaway:

Make sure you understand local council rules. Just because a property looks like a dual occupancy doesn’t mean it’s legally usable that way.

What is a Dual Key Property?

A dual key home is a single building split into two distinct living spaces—often with shared entryways or foyers, but separate lockable internal doors leading to each unit.

Think of it as a hybrid between a duplex and a granny flat, all on one title. It may be:

- A one-bedroom studio joined to a two-bedroom unit

- Two self-contained areas, sharing one main door and hallway

- A main home with a smaller unit tucked at the rear or side

Dual key properties are designed to generate two income streams from one mortgage and one set of outgoings—but they come with unique considerations.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

Dual Key vs Dual Occupancy vs Secondary Dwelling: What’s the Difference?

| Feature | Dual Occupancy | Dual Key | Primary/Secondary Dwelling |

|---|---|---|---|

| Separate Titles Possible | Sometimes | No | No |

| Separate Entrances | Yes | Sometimes shared | Often shared |

| Legal to Lease Both | Yes | Yes (check zoning) | Not always |

| One Mortgage | Usually | Yes | Yes |

| Popular with Investors | Yes | Niche | Yes (with limitations) |

Pros and Cons of Investing in Dual Key Homes

Advantages

- Double Rental Income on a single title

- Lower council rates and maintenance fees compared to two properties

- High potential to be positively geared—rents can help offset mortgage repayments

- Live in one unit, rent out the other (ideal for first-time investors)

- Great option for multi-generational living or carer arrangements

Disadvantages

- Lower resale appeal to owner-occupiers, limiting capital growth

- Tenant demand is often weaker than for traditional homes or apartments

- More complex lending requirements—banks treat them as higher risk

- Higher vacancy risk, particularly if tenants aren’t related or don’t know each other

- Can be harder to manage if you’re new to property investing

Financing and Lending Considerations

Banks generally take a more conservative approach to financing dual key and dual occupancy homes. Why?

Because:

- These properties are less liquid (harder to sell)

- The demand is limited mostly to investors—not the general buyer market

- Some areas restrict their use for investment purposes

Expect:

- Higher deposit requirements (often 20%+)

- Stricter serviceability checks

- Valuations that may not match the cost of construction or purchase price

How Tax Deductions Work for Dual Key Properties

If you’re investing in a dual key property, you’ll likely benefit from increased tax deductions. Why? Because you have two kitchens, two bathrooms, and multiple livable areas.

That means:

- More claimable depreciation (capital works and plant & equipment)

- Greater deductions on fixtures like air conditioners, dishwashers, ovens, washers and dryers

Keep in mind:

- If you’re living in one unit and renting out the other, you must proportionately split your claims.

- A qualified tax accountant or quantity surveyor can guide you here.

Depreciation: Why It’s Higher on Dual Key Investments

Dual key homes cost more to build per square metre because of the duplicate facilities. Kitchens and bathrooms are the most expensive areas to construct due to plumbing, tiling, and appliance requirements.

This additional complexity results in higher depreciation benefits, which is a major advantage for investors looking to offset income and improve cash flow.

Key Learnings for Investors

- Property investment success hinges on matching the right strategy to your goals.

- Don’t buy based on buzzwords. Understand the legal structure and use limitations of the property.

- Check zoning laws, rental restrictions, and development approvals in your state or local council.

- Consider long-term flexibility—can you upgrade or convert the property later for better resale?

- Always work with a qualified property strategist, broker, or planner before committing.

The Ideal Strategy? Renovation and Repositioning

Want to make the most of a dual key or dual occupancy property? Consider this:

- Buy undervalued stock

- Renovate to increase appeal and rentability

- Convert or reconfigure into a traditional single-dwelling home later to improve resale demand

That way, you gain short-term cash flow and long-term capital growth potential.

Is There Strong Tenant Demand for Dual Key Properties?

While dual key properties appeal to niche markets—such as multi-generational families or downsizers wanting extra income—they don’t have the same broad appeal as traditional homes.

Most Australian renters still prefer:

- Standalone homes with yards

- Apartments in central areas

- Clear boundaries between living spaces

That said, dual key properties are gaining traction in certain regions—especially where housing affordability is tight, and families are seeking flexible living arrangements.

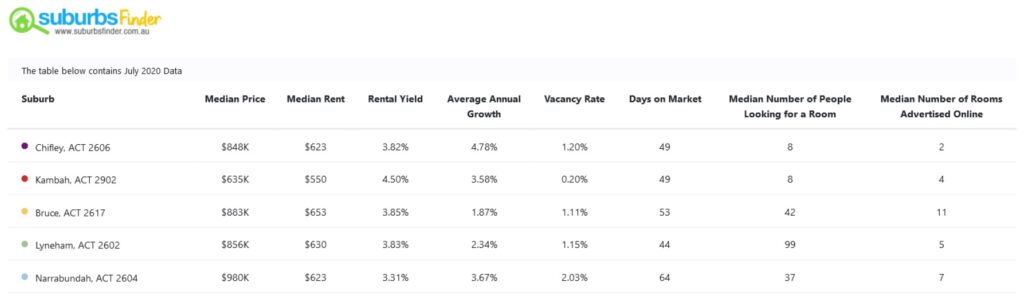

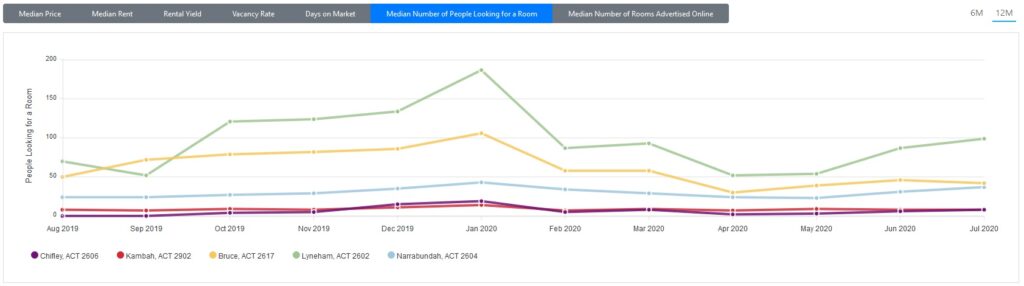

Where Are the Best Suburbs for Dual Key or Room-Based Investments?

If you want to invest in areas with:

- Strong room-by-room rental demand

- High capital growth potential

- Local zoning that allows for dual dwellings

… then you’ll need to dig deep into the data.

Or better yet, let SuburbsFinder do the work for you.

With just a few clicks, you can identify suburbs with:

- High rental demand

- Low vacancy rates

- Positive cash flow potential

- Strong long-term growth indicators

Watch: How to Find High Demand Suburbs for Renting Rooms

Explore: Room Rental Demand Report by SuburbsFinder

Check out our Room Rental Demand Report

Dual occupancy, dual key, and secondary dwellings all offer unique advantages, but they also come with their own sets of risks and limitations. Choosing the right strategy depends on your:

- Financial situation

- Investment goals

- Understanding of local planning laws

- Ability to manage more complex property setups

If you’re serious about maximising rental income and minimising risk, start with clear research and powerful tools to back your decisions.

SuburbsFinder helps you:

- Narrow down from 15,000+ suburbs using 40+ data filters

- Compare historical and current suburb performance

- Run feasibility studies on up to 5 properties at once

- Save time, budget, and effort across your entire research workflow

Get started today and take the guesswork out of dual occupancy investing.

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcode. It’s the perfect tool for property investors looking to buy a property to rent out rooms individually to have a positively geared portfolio.