Whether you’re a first-time investor, a rentvester, or a seasoned property buyer looking to diversify your portfolio, Tasmania is a market worth considering. This small island state south of mainland Australia continues to offer affordable entry points, strong rental demand, and resilient market conditions—making it an increasingly popular option for savvy investors.

Let’s explore where and how to find the best suburbs to invest in across Tasmania.

Why Tasmania is Gaining Attention from Investors

Tasmania combines affordability with a strong rental market, steady capital growth in key areas, and an appealing lifestyle that continues to draw both owner-occupiers and tenants. From Hobart’s established demand to Launceston’s university precincts and the budget-friendly northwest coast, Tasmania offers a diverse mix of suburbs and investment opportunities.

Where to Start Looking for Property in Tasmania

Hobart: The Capital Hotspot

Hobart remains the most sought-after market in Tasmania. Units near the University of Tasmania (UTAS) appeal to students and offer consistent returns. Family homes in Hobart’s northern suburbs are another reliable option, particularly for long-term tenancies.

Launceston: The Up-and-Comer

As Tasmania’s second-largest city, Launceston presents an attractive option for first-time investors. Its own UTAS campus supports rental demand in areas like Mowbray, Invermay, and Newnham—ideal suburbs for student accommodation.

The Northwest Coast: Affordability and Appeal

If you’re seeking lower entry prices, consider the northwest coast. This region offers affordable property prices, a slower pace of life, and steady rental demand.

Understanding Property Types in Tasmania

Positive Cashflow Properties

These properties generate more income from rent than they cost to hold (e.g. mortgage repayments, maintenance, insurance). A good cashflow property can help fund other investments and provide financial stability.

Negatively Geared Properties

These investments operate at a short-term loss, where rental income does not cover the full holding costs. However, investors may benefit from tax deductions, with long-term capital growth providing the real financial payoff.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

Key Tips When Investing in Tasmania

1. No Cooling-Off Period

In Tasmania, there is no standard cooling-off period. Once a contract is signed and the terms are unconditional, the sale is binding. This differs from other states like Victoria and South Australia, so legal advice before signing is strongly advised.

2. No Vendor’s Statement

There is no Section 32 or equivalent vendor disclosure in Tasmania. As the buyer, you are responsible for collecting relevant data about the property and conducting your own due diligence. This makes local advice crucial.

3. Be Mindful of Property Type

Water views are common in Hobart and don’t carry the same price premium as they do in cities like Sydney or Melbourne. Don’t assume water views equate to a premium price tag—Hobart locals often take them for granted.

4. Private Treaty is the Norm

Most sales in Tasmania are done via private treaty rather than auction. This allows for conditions such as subject to finance, pest and building inspections, or due diligence. Negotiate wisely to ensure you’re protected before signing.

5. Tenant Expectations: Heating is Essential

Unlike Queensland where air conditioning is a must, Hobart tenants prioritise heating. Ensure your investment property is equipped with sufficient heating—or budget for installing it if it’s missing. This is a non-negotiable for attracting and retaining tenants in Tasmania’s chilly winters.

Suburb Criteria for Smart Investment in Tasmania

Tasmania has a number of suburbs with strong fundamentals for property investment. Using smart filtering tools, you can quickly identify areas that:

- Have a median house price under $400,000 (many even under $300,000)

- Deliver rental yields above 5%

- Achieve more than 5% annual capital growth

- Maintain a vacancy rate under 3%

With this approach, you reduce risk while maximising your return on investment.

Using SuburbsFinder to Streamline Your Research

SuburbsFinder is Australia’s most comprehensive location research tool for property investors. Our system covers all 15,000+ suburbs nationwide and includes key metrics like:

- Median house price

- Rental yield

- Vacancy rate

- Capital growth

- Median rent

- Gross weekly income

- Mortgage repayment data

With filters for over 40 data points, you can tailor your search to match your goals, whether it’s cashflow, capital growth, or a hybrid of both.

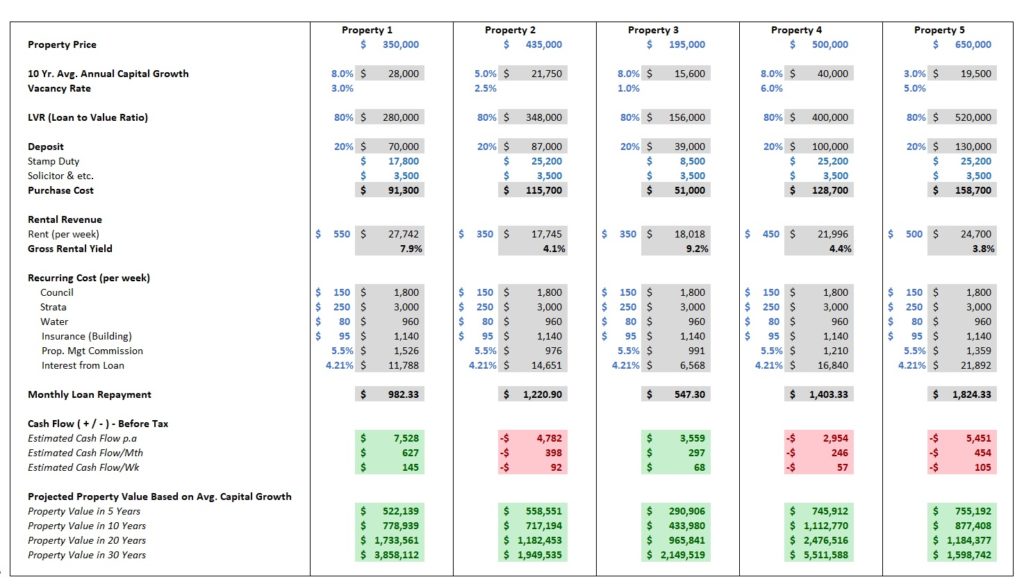

Make Informed Investment Decisions with Our All-in-One Calculator

After narrowing down your suburb shortlist, use our All-in-One Investment Property Calculator to compare up to five properties. You’ll instantly see:

- Estimated capital growth

- Rental yield

- Mortgage costs

- Purchase expenses

- Monthly and annual cash flow

This powerful tool ensures you don’t just buy a property—you buy the right property for your strategy and financial capacity.

Investing in Tasmania the Smart Way

Tasmania’s property market is full of potential—but only if you do your homework. Between the absence of cooling-off periods and the lack of vendor disclosure, investors need to approach this market with a sharp eye and solid research.

Whether your goal is cash flow, capital growth, or both, Tasmania offers a variety of entry points and property types to suit your strategy. Tools like SuburbsFinder will help you make data-driven decisions quickly and confidently, giving you a significant edge in today’s competitive market.

Ready to get started?

Sign up now to access our property research tools and suburb reports tailored to your budget and goals.