Thinking of investing in Adelaide? Wondering where you can find high-performing properties at affordable prices?

Adelaide remains one of Australia’s most affordable and liveable capital cities, offering a relaxed lifestyle, thriving cultural scene, and strong fundamentals for property investors. Unlike Sydney and Melbourne, Adelaide has avoided extreme volatility in the property market, with stable growth, lower interest rates, and consistent housing demand contributing to its resilience.

In 2025, investors are turning to Adelaide for its dependable returns, reasonable entry prices, and potential for long-term capital growth. This guide breaks down the key advantages, risks, and strategies to help you make informed decisions when investing in Adelaide property this year.

Why Adelaide is an Attractive Market for Investors in 2025

Adelaide may be a smaller city with slower population growth, but that doesn’t diminish its appeal. Its affordability, moderate but consistent capital growth, and stable rental yields make it a safe haven for savvy investors.

Key Advantages:

- More affordable entry prices compared to Sydney, Melbourne, and Brisbane

- Strong rental yields in many metro and inner-ring suburbs

- Less volatile market with fewer investor-driven booms and busts

- High liveability, arts and culture, and a laid-back lifestyle attracting renters and residents

- Government investment in infrastructure, healthcare, and clean energy sectors

Adelaide’s property prices have not skyrocketed like those on the east coast, meaning investors entering the market in 2025 may benefit from both affordable purchase prices and future capital growth as the market catches up.

👉 Watch: How to Find High Growth Suburbs in Seconds Using SuburbsFinder

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

What Makes Adelaide Unique?

Slower Population Growth (But That’s Changing)

Adelaide’s growth has traditionally been slower than other major capitals. The city’s population is aging, with a median age of 39, second only to Tasmania. However, state government initiatives are helping to attract skilled migrants, international students, and remote workers, which is likely to boost long-term demand for housing.

Well-Designed, Green City Layout

Adelaide’s city centre was designed with liveability in mind. Its grid-like layout, ample parklands, and wide streets make it appealing to both residents and investors. Green public spaces and good urban planning help maintain a high quality of life.

A Thriving Cultural Scene

Adelaide’s events calendar is a drawcard. With the Adelaide Fringe, WOMADelaide, and a vibrant wine and food scene, the city enjoys a strong local economy supported by tourism, arts, and hospitality.

Significant Infrastructure Investment

Infrastructure projects—including road upgrades, hospital redevelopments, and green space improvements—are driving jobs and increasing property demand. Strategic investors know that infrastructure-led growth often precedes property price growth.

Economic Resilience

The South Australian economy is relatively well-insulated. Its reliance on sectors such as agriculture, clean energy, healthcare, and education has helped Adelaide avoid some of the volatility seen elsewhere during economic downturns. The Greater Adelaide region includes 23 local government areas and accounts for a major share of South Australia’s economic output.

Things to Consider When Investing in Adelaide

1. Location is Everything

Focus on properties close to the CBD or key employment hubs. These areas typically deliver better rental returns, lower vacancy rates, and stronger capital growth. For budget-conscious buyers, inner-north or north-west suburbs can still offer value.

2. Inspect the Property

Always conduct thorough inspections or arrange a buyer’s agent to do so. Avoid major fixer-uppers unless you have the skills and budget for renovation.

3. Understand Cash Flow

Use property calculators to determine your projected cash flow. Make sure you can comfortably cover your mortgage and associated costs even during periods of vacancy.

4. Balance Yield and Growth

Aim to strike the right balance between strong rental yields and long-term capital growth. Properties closer to the city typically offer stronger appreciation, while regional or fringe locations may offer higher yields.

What Type of Property Should You Buy?

- Detached houses with land in middle-ring suburbs

- Low-maintenance townhouses in owner-occupier areas

- Units in boutique complexes with low body corporate fees

- Dual occupancy or granny flat setups (subject to council regulations)

Avoid high-rise apartments and oversupplied developments, especially in the CBD fringe, which often suffer from poor resale value and limited tenant demand.

Adelaide’s Market Outlook in 2025

Adelaide is forecast to continue its steady growth trajectory. While price growth may be slower than in booming markets, its lower volatility, affordability, and relatively high rental yields make it ideal for both first-time and portfolio investors.

As lifestyle trends evolve post-pandemic, more tenants are prioritising space, affordability, and access to green areas. This benefits well-located houses and larger dwellings in Adelaide’s inner and middle rings.

Where Should You Buy in Adelaide in 2025?

If you’re asking:

- Where can I buy below $600,000 in Adelaide?

- Which suburbs offer rental yields of 6% or more?

- What areas are showing consistent capital growth above 4%?

- Where is vacancy under 3%?

We’ve already done the heavy lifting.

With SuburbsFinder, you can filter and sort Adelaide suburbs by:

- Median property price (especially under $600k)

- Rental yield (6%+)

- Annual capital growth (4%+)

- Vacancy rate (under 3%)

- Strong demographic profiles

It is the most comprehensive investment location data of all 15,000+ suburbs in Australia – with linked state, suburb, postcode, average annual growth, median property value, median rent, gross rental yield, vacancy rate, population, gross weekly income, median monthly mortgage repayments and more. It’s perfect for property investors, buyer’s agent, real estate agents, property managers, mortgage brokers, valuers, and even property developers.

Once you’ve identified which suburbs in Adelaide are the best to invest in, don’t forget to do your due diligence and check if the numbers stack up!

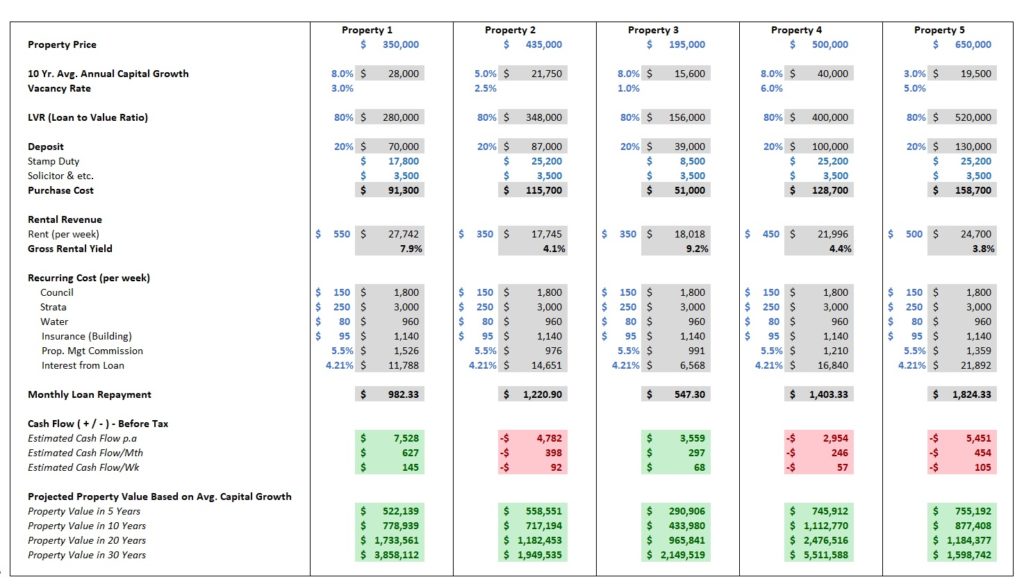

Check out our All-in-One Investment Property Calculator

The most simple and easy to use tool to calculate Rental Yield. It gives you a quick way to compare returns on different investment properties (or investments). It’s a Rental Yield Calculator, Mortgage or Homeloan Calculator, Cashflow Calculator, Purchase Cost Calculator, that also calculates Forecasted Property Value based on Capital Growth. It’s perfect for property investors, buyer’s agents, and real estate agents.

Don’t Forget to Run the Numbers

Use our all-in-one investment property calculator to:

- Compare up to five Adelaide properties side-by-side

- Calculate cash flow, upfront costs, and forecast returns

- Model capital growth and future resale value

It’s an ideal tool for property investors, buyer’s agents, and real estate professionals looking to make data-driven decisions in 2025.

Final Thoughts: Adelaide Investment in 2025

Adelaide continues to be one of the most stable and liveable markets in Australia. With lower entry prices, strong yields, and government-backed infrastructure projects, it offers strong upside potential for long-term investors.

Smart investing in 2025 means combining capital growth potential with steady rental income. Adelaide offers both—if you know where to look.

Ready to find your next investment suburb in Adelaide? Use SuburbsFinder to get instant access to suburb-level data and insights across South Australia.