If you’re new to property investing in Australia, you’re entering a market full of opportunity—but also plenty of noise. Real estate can build serious wealth, but only a small percentage of investors ever get past their first property. Fewer still go on to build a large portfolio that delivers financial freedom.

Why? Because while property investment seems straightforward, the reality is more complex. It requires solid planning, a data-driven mindset, and the ability to avoid common traps that catch so many beginners off guard.

Let’s break down what works, what doesn’t, and how you can build a successful start.

The Harsh Truth: Most New Investors Don’t Make It Far

Many investors begin their journey full of ambition. But the property cycle—booms, corrections, stagnation—doesn’t play favourites. You need to work smarter than the market.

The biggest mistake? Thinking the market will do the work for you. In reality, smart property selection, an aligned strategy, and a trusted team around you will make all the difference.

Here’s what beginners really need to know.

Top 10 Property Investment Tips for Beginners

1. Take Action—But Avoid Impulsiveness

Beginner investors tend to fall into one of two traps:

- The Impulsive: They jump in head-first after a seminar or podcast binge, buying a poorly researched property on hype alone. When things don’t go to plan, they give up.

- The Over-Thinker: Paralysed by information, they spend months (or years) “learning” but never actually invest. This is the classic case of analysis paralysis.

The secret? Find the middle ground. Yes, educate yourself. But at some point, you must take calculated action. The best learning happens in the field.

And forget about timing the market. Even the experts get it wrong. Focus instead on buying quality assets in growth areas—then hold long term.

2. Use Logic Over Emotion

Buying an investment property is not the same as buying a home to live in.

Yet, many investors get emotionally attached: “It has amazing views!” “I’d live there!” That’s not the point.

Successful investors assess based on logic:

- Are the local demographics trending upward?

- Is this suburb appealing to quality tenants?

- Will owner-occupier demand support price growth?

Make sure your property ticks boxes for rental demand, capital growth, and long-term value. Let the numbers guide your decision—not your heart.

3. Plan Ahead or Prepare to Fail

Not having a strategy is like setting off on a road trip without a destination.

What are your goals?

- Passive income of $60,000 a year in 15 years?

- Early retirement?

- Financial buffer for your kids’ education?

Once your destination is clear, reverse-engineer a strategy. Work out how many properties you’ll need, at what price points, and what kind of yield or capital growth will support your goals.

Your plan should cover:

- Budget and borrowing power

- Timeframe to grow your portfolio

- Cash flow vs. growth priorities

- Contingencies for interest rate changes or vacancies

Map it all out. And better yet—build a custom strategy with expert guidance.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

4. Avoid the Wrong Property Choice

It’s one of the most expensive mistakes you can make—buying the wrong property in the wrong location.

Questions to ask before buying:

- Is the area being gentrified?

- Is it attracting high-income professionals?

- Are there infrastructure upgrades coming?

- Is rental demand strong?

Only about 2% of properties in Australia are considered true “investment-grade” stock. These are the kinds of properties that will outperform long term. The rest? Not worth the risk.

5. Patience Over Profit-Chasing

Many beginners think property is a get-rich-quick scheme.

Spoiler: it’s not.

Short-term flips, unless backed by expert renovation or development skills, often fail. What works is long-term wealth building through consistent capital growth and smart leverage.

Most successful investors grow their wealth over 20 to 30 years—using equity from one property to fund the next. It’s the compound effect in action.

Forget the sprint. Think marathon.

6. Do Your Homework Properly

Reading a book or attending a seminar won’t make you an expert.

Real research involves:

- Suburb-level data analysis

- Checking vacancy rates, rental yields, and days on market

- Tracking gentrification and infrastructure changes

- Physically visiting open homes and speaking with local agents

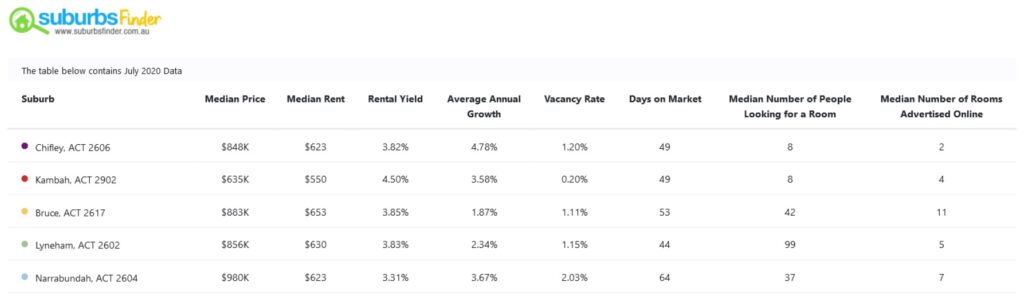

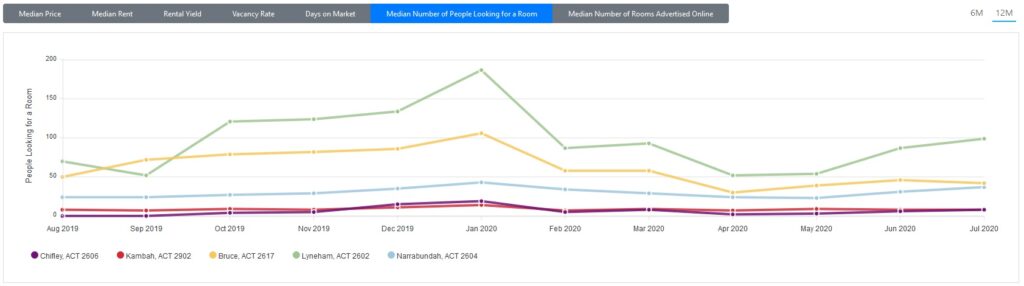

The biggest gap for most beginners is context. They can’t yet distinguish a good deal from a dud. That’s where platforms like SuburbsFinder can help—consolidating 40+ data points to filter the best suburbs for investment.

7. Understand the Backstory of Each Deal

Once you’ve found a property, dig deeper.

- Why is the seller moving? Are they in distress? Downsizing?

- How long has it been on the market?

- Any pest or building issues?

- What’s the rental demand like in this street?

Do multiple inspections—at different times of day. Understand lighting, noise levels, parking, and neighbour quality. These micro-details often influence rental appeal and resale value more than you’d think.

8. Manage Your Cash Flow Like a Business

Your property is not a passion project—it’s a financial investment. Poor cash flow planning will bring you undone.

Make sure you:

- Forecast ALL expenses: land tax, strata, insurance, maintenance

- Know your rental income versus repayments

- Plan for vacancies and rate rises

- Set aside a 10% buffer of the property value for annual costs

And most importantly: overestimate expenses and underestimate income—that way, you’ll never be caught off guard.

9. Don’t Self-Manage Unless You Know What You’re Doing

Managing your own property might save on fees—but at what cost?

A professional property manager will:

- Screen and manage quality tenants

- Handle disputes, maintenance, and legal issues

- Ensure compliance with tenancy laws

- Save you from after-hours calls about leaky taps

More importantly, they protect your time—letting you focus on scaling your portfolio, not babysitting it.

10. Get Proper Financial Advice

The most successful investors don’t just wing it.

They build a power team around them—starting with a great mortgage broker who understands investment finance.

A smart broker will:

- Help you structure your loans for growth

- Find lender policies suited to investors

- Maximise borrowing power and minimise risk

One good financing decision early on can save you hundreds of thousands over the life of your portfolio.

Final Advice: Don’t Chase Shiny Objects—Chase Strategy

There’s no shortage of “hot tips” and “can’t-miss” properties in the market. But don’t get sucked in by hype.

Instead:

- Stick to a clear investment strategy

- Use data to drive your decisions

- Build your team of experts

- Leverage tools that save you time and help you avoid costly mistakes

Let SuburbsFinder Be Your Research Engine

If you’re ready to get serious about property investment, you need more than spreadsheets and guesswork. You need real data, custom filters, and time-saving tools.

SuburbsFinder gives you:

- A filterable database of 15,000+ suburbs

- 40+ metrics to identify high-growth, positive cash flow areas

- Side-by-side analysis of up to five properties

- Historical vs. current suburb performance insights

- A feasibility calculator for quick due diligence

Whether you’re buying your first investment or scaling to your fifth, this platform is designed to help you make smarter, faster decisions.

Try It Free – Save Hours of Research

If you think this will cut your research time in half—and help you find the right investment based on your goals and finances—why not give it a try?

You’ll gain access to:

- Australia’s most comprehensive suburb-level location report

- Linked suburb, postcode, and state data

- Tools tailored to investors who want to rent by room for maximum positive cash flow

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcode. It’s the perfect tool for property investors looking to buy a property to rent out rooms individually to have a positively geared portfolio.