Buyers unanimously lament why they were not in the market early on when a property market booms.

Whether you’re a property investor, a first home buyer, or someone who wants to upgrade your home, it pays to check the emerging suburbs. Emerging suburbs should form part of any investor’s portfolio because they can provide growth opportunities well beyond suburbs where prices have already gotten too high.

Here are a few things you need to know when considering emerging suburbs.

Definition of an Emerging Suburb

An emerging suburb is a property where prices will soar faster than other locations.

It is a rising suburb next to blue-chip suburbs enjoying premium prices already.

The area is undergoing a growth transition primarily because buyers could not afford the expensive blue-chip suburb and now turning their gaze into the adjoining suburbs. A ripple effect is happening.

Most emerging suburbs are results of gentrification. This means changes in demographics happen in established suburbs, and the older properties are either knocked down or upgraded to construct new and modernised homes.

The new developments or infrastructure, such as public transport centres, business hubs, educational establishments, medical facilities, and shopping centres, may also transform a suburb from an ignored location to a most sought-after one.

Why is looking at emerging suburbs important?

Astute property investors keep an eye at emerging suburbs because they can be among the most exciting areas to invest in. They have potential to create higher equity in a shorter amount of time.

Doing the Maths!

QUESTION: What would you do if you were given a choice: buying a house in a blue-chip suburb (forecasted growth at 7% per annum) OR an emerging suburb ( forecasted growth at 12% per annum)?

Undoubtedly, what will win you over is the emerging suburb. Why? Granted it meets the other investment goals you have, it is the one that will potentially give you better returns on your interest.

And to maximize the capital growth is really to identify the indicators and gentrification phases early on.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

What are the signs of a flourishing suburb?

As no one can foresee the booming areas of the future, there are several indicators that can help you spot an emerging suburb.

To help you recognize these indicators faster and more efficiently, you can check these online using SuburbsFinder Dashboard.

With the tool, you can check out property prices and what their historical trends are showing: going upward, going downward, or showing not much activity at all. On the dashboards, you can also find out about the demographics of an area. Look for tell-tale signs of specific demographic changes, like the influx of more young professionals and residents with college or university degrees relocating to the suburb. There are also data on some infrastructure plans and development projects for growth, as well as links to council websites.

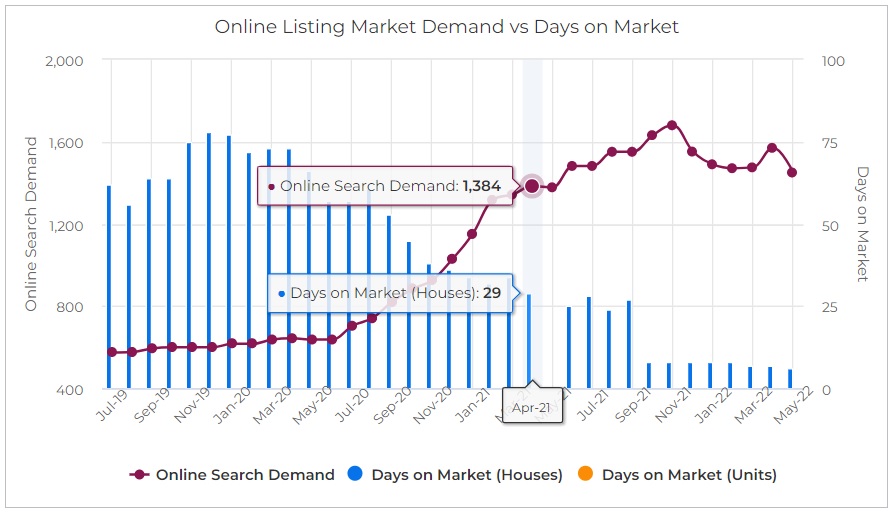

SuburbsFinder lets you overlay Days on Market versus Online Listing Market Demand to provide a better understanding on what’s happening in a particular suburb

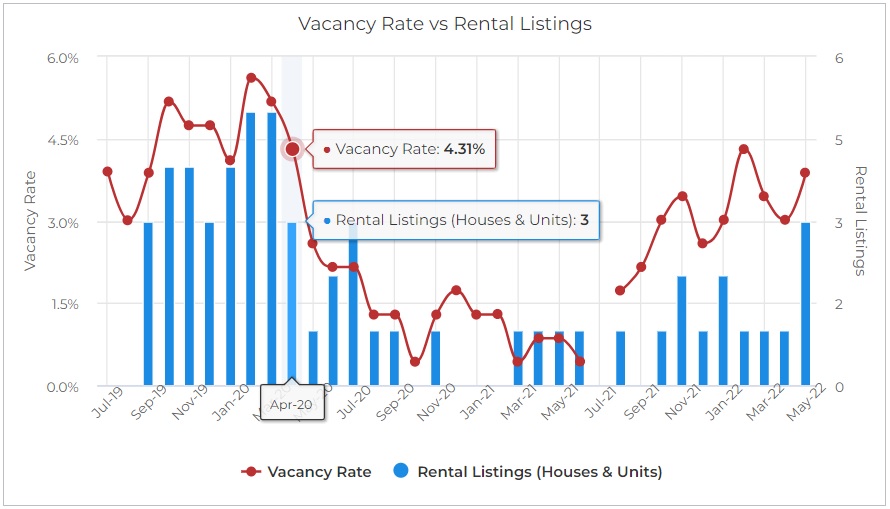

Due to Vacancy Rate being post code level, SuburbsFinder overlays it against the Total Rental Listings to provide clearer rental demand performance of a suburb

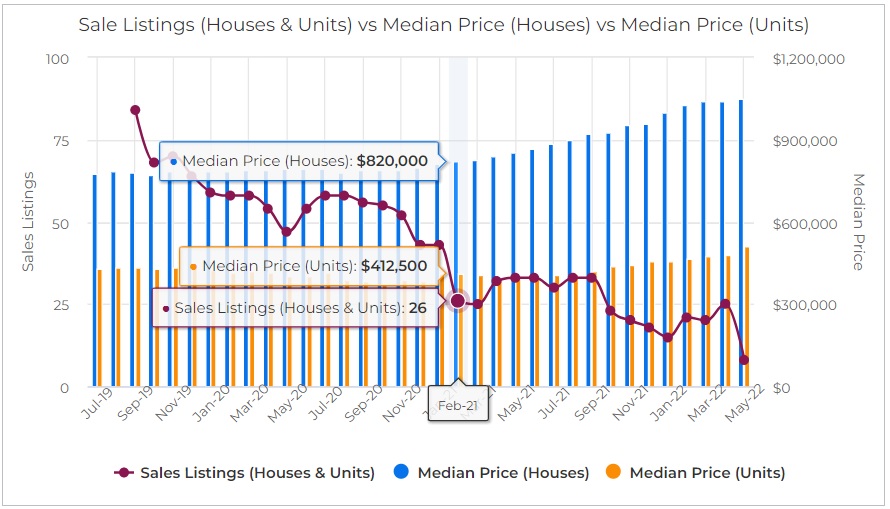

SuburbsFinder overlays Sale Listings with Median Price for both Houses and Units showing the impact on price when supply can’t keep up with the demand

Aside from checking out the indicators online, a physical visit of your shortlisted suburbs, is also ideal, to have a feel of the area and subsequently help you firm up the data on your dashboards.

When doing a physical visit, here is a list of activities to do and things to look out for:

- Have a stroll along the suburb’s streets and check the predominant type of houses in the neighbourhood. Are there more old homes or newer homes? What conditions do they have? Are these old homes being torn down or upgraded?

- Try to visit local cafes, shops, and restaurants to know what types of food are being served? Check out the customers they’re bringing together.

- Go to the parks while walking the dog. Have a friendly chat with some dog owners you may see and ask them subtly regarding the property prices and the latest council improvements in the area.

- Observe the car models parked on the streets and the driveways. If there are luxurious cars like Teslas and BMWs parked in front of worn-out period homes, this could indicate one thing: cashed-up owners who can renovate their property if they choose to.

- Spot the age groups of the locals and residents in the suburb– if an inner-city suburb, for instance, is filled with plenty of seniors, there could be looming significant changes in the area.

What is the ripple effect?

Property investors who are aware of the ripple effect, are in the best position to snare an emerging suburb easily.

When buyers are priced out of their desired suburb, they often continue with their search by turning to the nearby suburbs, to find a good property that is within their budget.

When buyers are priced out of their desired suburb, they often continue with their search by turning to the nearby suburbs, to find a good property that is within their budget.

And as more buyers are pressed to make this move, demand increases, which in turn drives the prices up in the adjacent suburbs. This is what we call the ‘ripple effect.’

The property prices in inner-city suburbs typically are the first to appreciate when there is a growth cycle in the property market. With the ripple effect, the price growth extends outwardly from these suburbs to their neighbouring suburbs.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

A Case Study of an Emerging Suburb: Redfern

Beginnings: Pre-gentrification

Redfern has been Australia’s “Black Heart” for several years, being a centre for the indigenous communities.

It was virtually a much-restricted area for many people from Sydney because of its dismal standing as a suburb with these unfavourable incidences: graffiti, drug use, assaults, fire, and violence. In addition, there were headline-grabbing riots that happened in 2004 at this location. It doesn’t paint a very conducive place for a home and raising a family. The ballpark figure for the city’s average house price was $500,000.

Check out “How to make use of Supply and Demand Indicators when it comes to investing property?“

Post-gentrification Period

The Waterloo or Redfern Authority was established in 2004 to oversee this suburb’s hasty and much-needed development. With the shift in demographics, Redfern’s list of amenities has improved, too.

Redfern, thus, became popular among profitable and promising local businesses and tech start-ups.

RESULTS: How is Redfern now?

Redfern transformed into what is to become an addition or expansion of nearby Surry Hills -a wealthy suburb over the years.

There are chic boutiques, quaint cafes, modern restaurants, medical services, and cosy hangout places for its residents.

The city’s average house price now is worth over $1,000,000.