As Australia’s third-largest city, Brisbane continues to present outstanding opportunities for property investors. With its rising population, expanding infrastructure, and relative affordability compared to Sydney and Melbourne, Brisbane remains one of the top capital city markets to watch in 2025.

But not all parts of Brisbane will perform equally—and choosing the right property, in the right suburb, at the right price, can mean the difference between long-term wealth and long-term regret. This guide will help you identify where and how to invest in Brisbane property in 2025 with confidence.

Why Brisbane is a Top Investment Location in 2025

Brisbane is one of Australia’s fastest-growing cities in both population and job creation. The city’s population is forecast to surpass 3 million well before 2035, fuelled by interstate migration, international arrivals, and a strong pipeline of infrastructure and commercial development—including preparations for the 2032 Olympic Games.

Here’s what makes Brisbane so attractive right now:

- Affordability compared to other east coast capitals

- Strong capital growth in select suburbs since 2020

- High demand from both renters and owner-occupiers

- Major infrastructure projects including transport, entertainment, and medical precincts

- Increasing liveability and lifestyle appeal

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

What Makes a Good Investment Property in Brisbane?

To ensure long-term performance, a Brisbane investment property should meet several key criteria:

1. Location

Proximity to transport, employment hubs, schools, cafes, and retail makes all the difference. Stick to suburbs with strong owner-occupier appeal and low vacancy rates.

2. Property Type

Go for flexible configurations that suit a broad rental market—free-standing homes, townhouses in boutique complexes, or oversized apartments in low-density blocks.

3. Desirability & Liveability

Look for well-designed properties that renters want to live in. Poor layouts, dark interiors, and limited outdoor space are turn-offs in Brisbane’s climate.

4. Price & Value

Avoid overpaying. Seek properties priced below intrinsic value or with room for value-adding. Discounts, distressed sales, or tired homes in blue-chip locations can offer great upside.

What to Avoid When Investing in Brisbane

Even in a booming city, some property choices will underperform—or worse, go backwards.

- Wrong Property Types: Oversupply-prone stock such as high-rise units or investor-heavy developments offer poor capital growth and face long vacancy periods.

- Wrong Suburbs: Suburbs with high new housing supply, poor transport, or low owner-occupier appeal are risky. Rental demand may be weak, and values may stagnate.

- Overpaying: Too many investors rely on slick marketing packages or interstate spruikers who overhype projects. Always assess true value using local comparables and yield benchmarks.

Unique Considerations When Buying in Brisbane

Flood Zones

Flooding is a real risk in parts of Brisbane. Use Brisbane City Council’s free flood maps to check past events and identify flood-prone areas. Avoid these zones or factor mitigation costs into your buying decision.

Lifestyle Preferences

Brisbane’s relaxed lifestyle is different from Sydney or Melbourne. Locals value breezy homes, covered patios, and air-conditioning over enclosed garages or ultra-modern finishes.

Topography & Orientation

Brisbane’s hills are a feature, not a flaw. Elevated positions with breezes and views are highly desirable—especially during the hot summers. But beware west-facing homes or those exposed to intense afternoon sun.

Council Uniformity

One major advantage of Brisbane is that the entire metropolitan area falls under one council. Unlike Sydney or Melbourne where rules vary between LGAs, this makes town planning, renovations, and development more straightforward.

Where to Invest in Brisbane in 2025?

Savvy investors in 2025 are asking:

- Which Brisbane suburbs have a median price under $500k?

- Where can I find yields of 5% or more?

- What areas are showing annual capital growth of 4%+?

- Where is rental demand rising and vacancy rates under 3%?

The great news? You don’t have to manually hunt down this data. SuburbsFinder does all the heavy lifting.

With just a few filters, you can instantly find Brisbane suburbs that:

- Have solid demographics and income growth

- Are under $500k median price

- Offer more than 4% annual capital growth

- Offer more than 5% gross rental yields

- Have less than 3% vacancy rates

Watch: How to Find High Growth Suburbs in Brisbane in Seconds

Tips for Buying Investment Property in Brisbane

- Stick to Owner-Occupier Hotspots: Prioritise suburbs where owner-occupiers dominate the market. These locations tend to perform better during downturns and offer more sustainable growth.

- Stay Close to Brisbane’s Median: Avoid extreme outliers in price. The majority of transactions occur near the citywide median—this is where depth of demand is strongest.

- Avoid High-Density Developments: Steer clear of high-rise apartments and investor-saturated pockets. These often suffer from oversupply and poor capital growth.

Crunch the Numbers Before You Buy

Don’t just fall in love with the suburb—run the numbers.

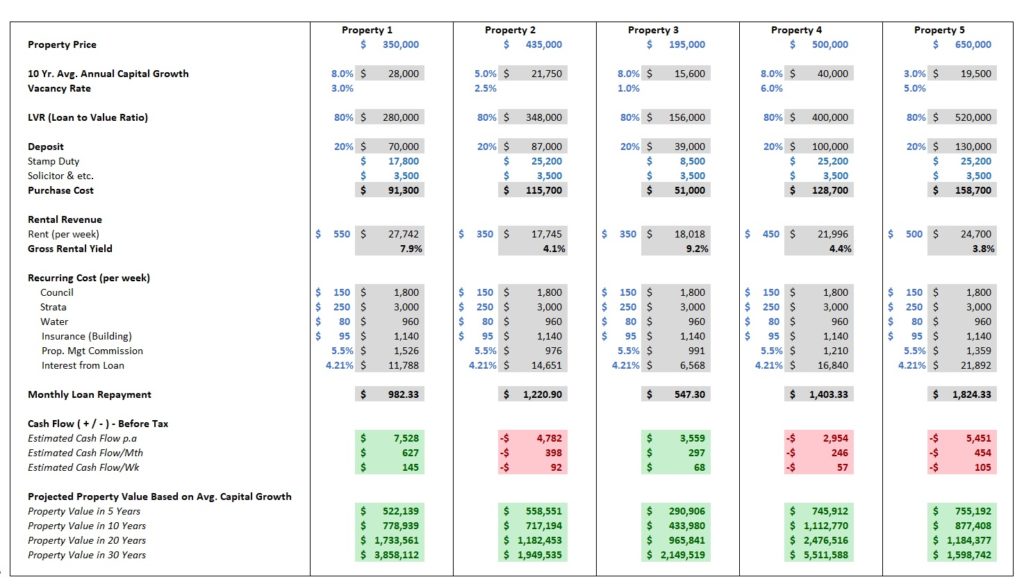

Use our all-in-one property investment calculator to compare up to five Brisbane properties and calculate:

- Gross rental yield

- Monthly cash flow

- Upfront purchase costs

- Estimated capital growth

- Overall ROI

This tool combines a Rental Yield Calculator, Mortgage Calculator, Cashflow Calculator, and Purchase Cost Calculator in one simple interface.

Final Thoughts: Brisbane is a 2025 Hotspot, But You Still Need to Be Strategic

Yes, Brisbane is a standout capital city for property investment in 2025. But the city is not one market. Different suburbs, property types, and price points will produce very different results.

With a solid data-driven strategy, local knowledge, and proper due diligence, you can take advantage of Brisbane’s growth trajectory while minimising your risk.

If you’re ready to find the best Brisbane suburbs for investment, access our full location insights tool and pinpoint suburbs with the exact mix of capital growth, rental yield, and demand you need.

Try the Investment Property Research Tool

Let Brisbane be the cornerstone of your next property move—done smartly, it could power your portfolio for the next decade.

Check out our All-in-One Investment Property Calculator

The most simple and easy to use tool to calculate Rental Yield. It gives you a quick way to compare returns on different investment properties (or investments). It’s a Rental Yield Calculator, Mortgage or Homeloan Calculator, Cashflow Calculator, Purchase Cost Calculator, and it also calculates the Forecasted Property Value by Capital Growth. It’s perfect for property investors, buyer’s agent, and real estate agents.